More people in the US are tuning into Connected TVs (CTVs) than watching traditional TV or using social media. CTVs are the primary gateway for OTT (Over-The-Top) streaming, gaming, and accessing linear TV through digital providers.

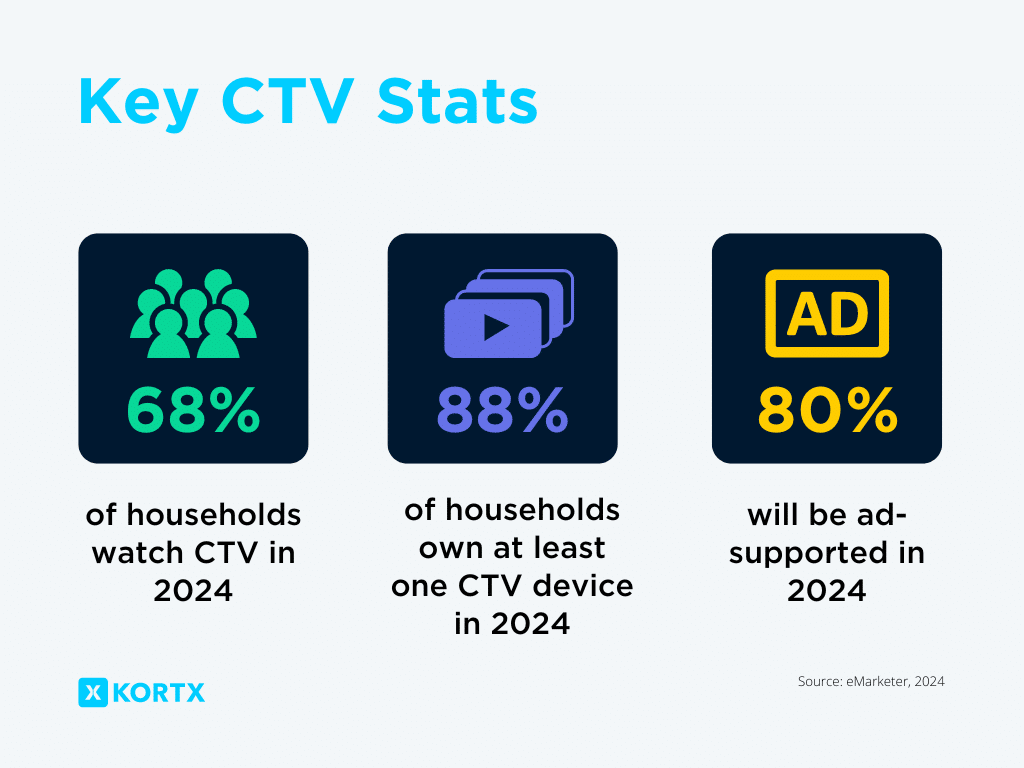

Review key CTV statistics for 2024, highlighting insights on audience behavior, ad spending, and industry dynamics, emphasizing the platform’s growing relevance for advertisers.

CTV Audience Size & Viewership Demographics

The transition from linear TV to CTV is accelerating as viewers gravitate towards internet-connected devices.

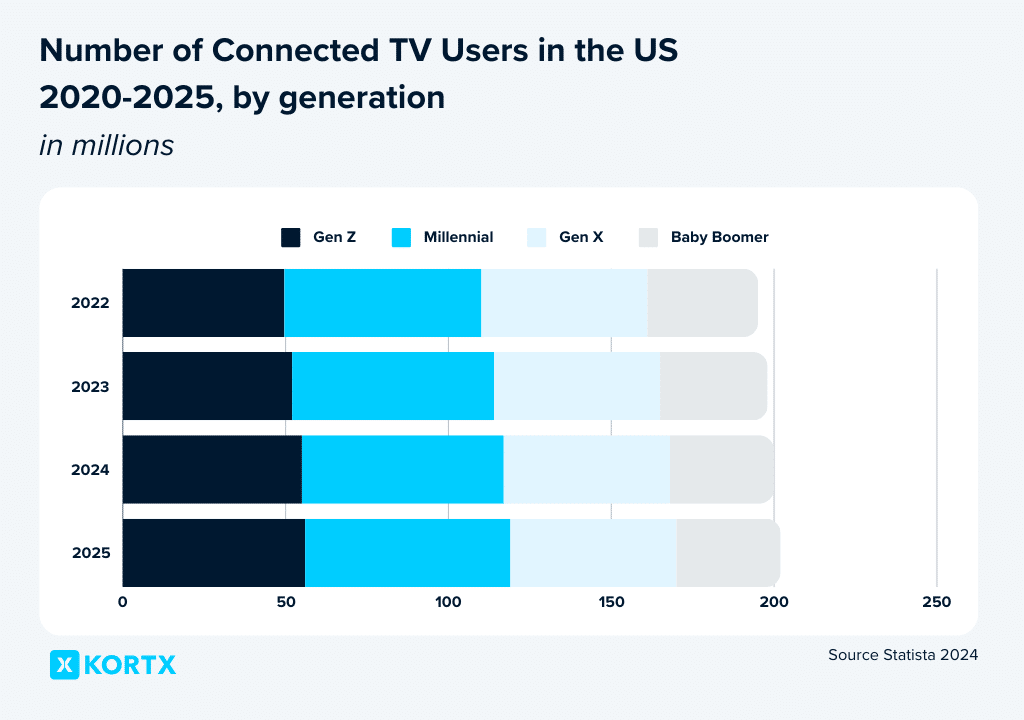

Connected TV Viewership Demographics

- Millennial Users: 56.8 million millennials use connected TVs. This is projected to reach 62.6 million by 2025.

- Age Group Ownership: Over one-third of respondents in every age group own a connected or smart TV. The 18-34 age group has the lowest share at 46%, while 71% of those aged 35-54 and 54% of those over 55 own these devices.

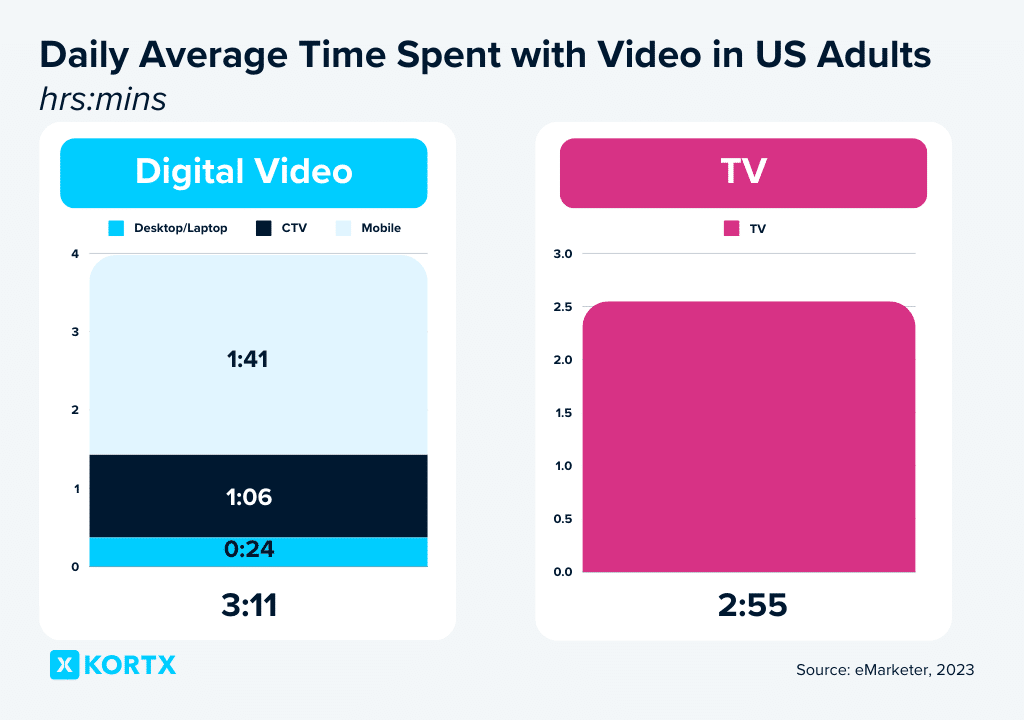

CTV Time Spent

Over the past four years, time spent on CTV devices has nearly doubled, driven by increased viewership of subscription OTT (Over-The-Top) services like Amazon Prime and Netflix, AVOD (Advertising-Based Video-On-Demand) services like Hulu and Tubi, and YouTube.

Currently, US adults spend an average of 1 hour and 51 minutes daily on CTV devices like Apple TV, Roku, and Amazon Fire TV.

- Viewing Time Growth: Time spent with CTVs is projected to grow 8.3% in 2024, reaching 2 hours and 16 minutes per day.

- Market Share: CTV time spent accounts for 84% of time spent with “other connected devices.”

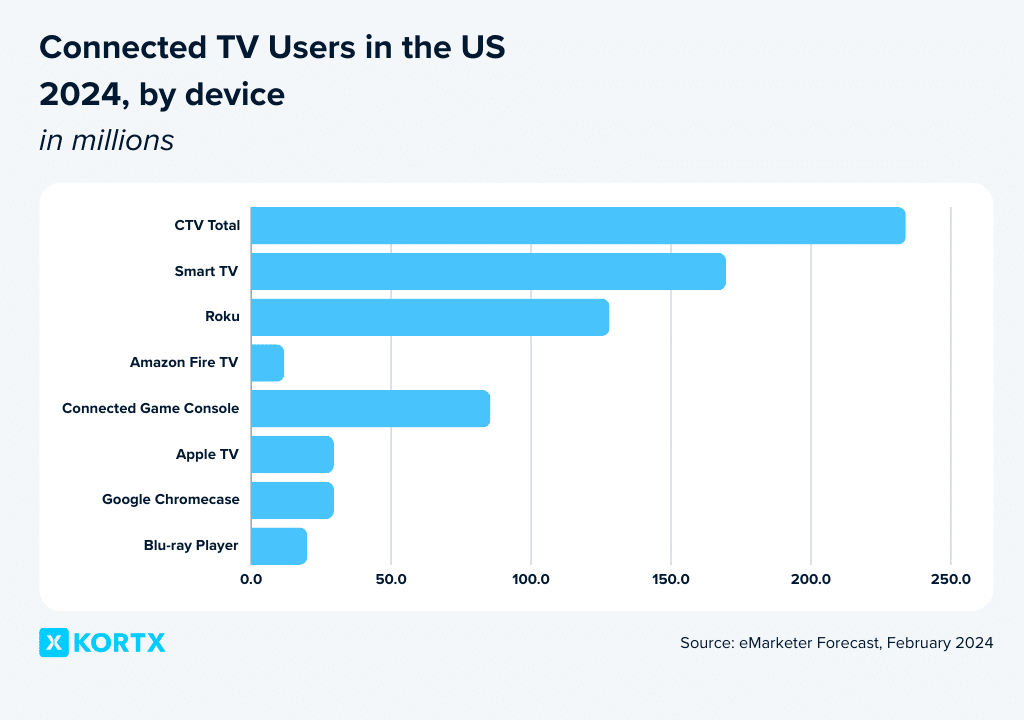

Device Preferences

There are numerous ways to access CTV, some more popular than others. Categories like smart TVs, Roku TVs, and Google Chromecast often overlap, as many households use multiple devices for their CTV services.

- Roku’s Market Position: Roku remains the industry leader, but its share is plateauing. A modest 2.7% growth is expected this year—the lowest since 2010.

- This is declining due to the increasing popularity of smart TVs.

- Smart TVs’ Dominance: Smart TVs are the fastest-growing CTV option, expected to be used by over 75% of US CTV users by 2027.

- By 2028, smart TV users will outnumber Roku users by more than 53 million, like Sony, Samsung, and Amazon Fire.

- Digital Video Ad Views: In the first half of 2023, digital video ad views on connected TV accounted for 76% of all digital video ad views. Mobile devices accounted for 13%.

What are the most significant trends you see in CTV advertising for 2024?

“FAST (Free, Ad-Supported TV) and AVOD (Advertising Video-On-Demand) are increasingly challenging SVOD (Subscription Video-On-Demand).

The increasing popularity of FAST and AVOD services is largely due to the value exchange they offer: viewers are willing to watch ads in exchange for free or reduced-cost content. This model provides a cost-effective alternative for consumers tightening their belts, while also allowing advertisers to reach a broader, engaged audience. It’s a win-win situation, driving the steady march towards ad-supported models gaining scale.”

📚 Related article: Interactive CTV Ads: The Secret to Higher Engagement

Read more about the power of Interactive CTV advertising and how it outperforms traditional linear television ads.

Ad-Supported vs. Ad-Free Streaming

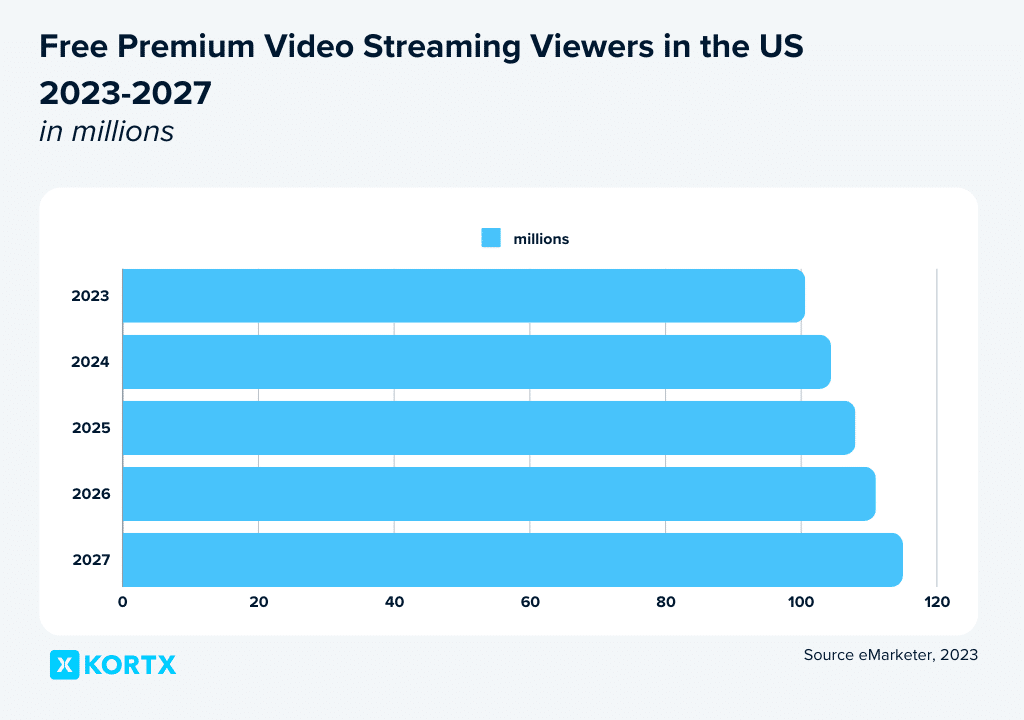

Free Ad-Supported Streaming TV (FAST)

FAST (Free Ad-Supported Streaming TV) appeals to consumers due to its low entry point for both audiences and advertisers. Viewers appreciate the free access, while marketers benefit from cheaper, widely distributed ads that can be bought programmatically.

- Growth in Viewership: There will be 111.5 million FAST viewers in 2024, with platforms like Pluto TV, The Roku Channel, and Tubi leading the way.

- Popular FAST Platforms: Excluding YouTube, three of the top six streaming services with the most ad-supported viewers in 2024 will be FASTs: The Roku Channel, Tubi, and Pluto TV. These services attract casual viewers and facilitate easy, passive consumption.

How many ad breaks are acceptable from FASTs?

- 65% of US consumers find two or three ad breaks per hour of FAST content acceptable.

- 33% prefer ad breaks under 30 seconds, while 23% prefer breaks under 15 seconds.

YouTube tested fewer, longer ad breaks on connected TVs, resulting in 29% longer viewing sessions. Also, most viewers prefer knowing the total time remaining in the ad break.

Subscription Streaming Services & Advertising

The transition to ad-supported viewing on services like Netflix, Disney+, and Max will be gradual, with most viewing remaining ad-free for the foreseeable future.

- Amazon Prime Video: 80% of US viewers will be ad-supported in 2024, the highest share among subscription streaming services.

- Subsidized Ad Tiers: Paramount+, Disney +/Hulu, and Peacock use discounts, bundles, and promotions to convince over two-thirds of their viewers to adopt ad-supported plans.

- New Sign-Ups and Advertising: Ad-supported viewers will make up just 7.5% of Netflix’s total US viewers in 2024. In Q4 2023, about 40% of new Netflix sign-ups in markets offering ads opted for ad-supported tiers.

📚 Related article: FAST TV: How Ad-Supported Streaming Works

Read more about why you need a FAST advertising strategy today.

Digital Pay TV

Digital pay TV, also known as virtual multichannel video programming distributor (vMVPD), delivers live TV digitally. Customers pay to access multiple channels through live TV services like YouTube TV and Sling TV.

- Subscriber Growth: Digital pay TV services grew from 700,000 US households in 2015 to 17.8 million in 2024.

- Market Share: Digital pay TV will account for one-fourth of total US pay TV subscribers in 2024, attracting both cord-cutters and cord-nevers.

- Subscription Trends: Over 19 million US households will subscribe to digital pay TV in 2024, with YouTube TV leading the way with 21.5 million viewers.

Combining traditional pay TV with digital pay TV, the majority of US households will still subscribe to some form of pay TV in 2024 and 2025.

CTV Ad Spend & Marketing Trends

Connected TV (CTV) is the fastest-growing major ad channel in the US of all the formats. It’s projected to grow 22.4% to reach a total of $30.10 billion in 2024.

Ad Spend Growth

- Market Share and Spending: In 2019, CTV accounted for less than one-tenth of total video ad spending. By 2024, it will represent about one-third, with CTV and linear TV spending expected to be nearly equal by 2028.

- Upfront/Newfront Spending: CTV video ad spending is projected to reach $13.84 billion in 2024, a 43.5% increase from 2023. On average, connected TV ad spending per hour spent with CTV is $0.14 per person.

- Impact of Major Events: The 2024 Summer Olympics and political elections will stabilize linear TV spending temporarily. However, continued cord-cutting will cause a significant 13.3% decline in linear TV ad spending by 2025.

- Retail Media Ad Spending: Retail media CTV ad spending is projected to reach $4.19 billion, reflecting an 86.6% increase.

Subscription & Ad-Supported CTV Models

- Revenue Composition: Subscription fees will account for about two-thirds of total revenues for US streaming services in 2024.

- Netflix and Hulu: Netflix will generate $70.44 in ad revenues per ad-supported viewer in 2024, 53.6% more than Hulu. However, Hulu will have over six times the number of US ad-supported viewers, resulting in higher overall CTV ad revenues.

- FAST and YouTube: FAST CPMs (costs per thousand impressions) range between $10 and $15, similar to YouTube’s CPMs. Hulu’s CPMs are around $25, and Peacock’s are around $38.

📚 Related article: How to Advertise on Netflix

Want to advertise on Netflix? This article details everything you need to know.

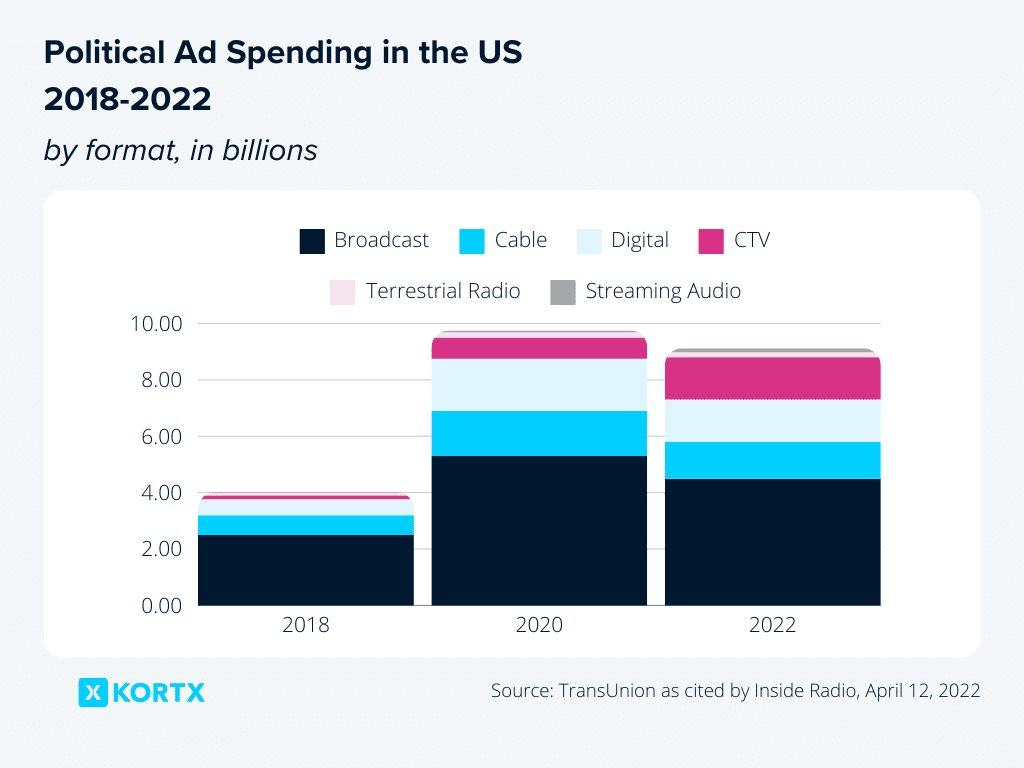

Political Advertising Dynamics

In 2020, political advertising primarily relied on its tried-and-true linear TV strategies for election campaigns. This year, CTV is playing a more prominent role in election season marketing.

- Traditional Media Reliance: In 2024, linear TV will account for 57.3% of all political ad spending, with 71.9% of total political ad spending going towards traditional media.

- Linear vs. CTV Political Ad Spending:

- Linear TV: Political ad spending on linear TV will reach $7.06 billion in 2024.

- CTV: Political ad spending on CTV will be $1.56 billion, nearly half of all US digital political ad spending, marking a 506.3% growth from 2020 to 2024.

How has the adoption of CTV changed the landscape of digital advertising?

“CTV allows for more precise audience targeting and real-time data analytics, enabling advertisers to deliver highly relevant and engaging ads. The interactive nature of CTV ads also offers a richer user experience, driving higher engagement rates compared to traditional TV.

The shift to CTV has opened up new opportunities for advertisers to reach cord-cutters and cord-nevers, expanding their reach to a more diverse and tech-savvy audience. As a result, CTV has become an essential component of any comprehensive digital advertising strategy.”

Marketer Insights and Trends

A series of surveys conducted among video marketers in the United States reveal key insights into their perspectives and strategies regarding connected TV (CTV) advertising.

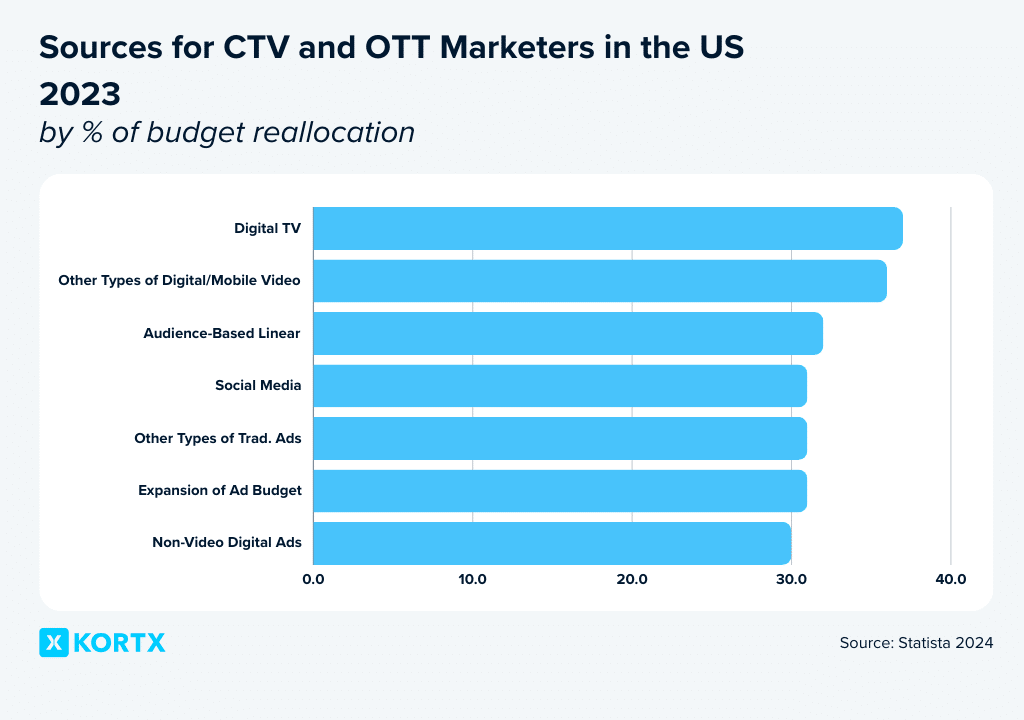

Budget Reallocation

- Reallocation from Digital TV: 37% of respondents increasing their CTV ad spend for 2023 are reallocating budgets from digital TV.

- Reallocation from Digital and Mobile Video: 36% of respondents are reallocating budgets from other types of digital and mobile video.

Importance of CTV Advertising

- CTV as a Must-Buy: 65% of video marketers consider CTV advertising a must-buy for their media plans.

- National Broadcast and Cable TV: 38% of respondents cited these as essential.

Ad-Supported Advertising Interest

- Rising Advertiser Numbers: Disney+ reported a tenfold increase in advertisers since launching its ad tier in 2022. Similarly, Peacock’s advertiser numbers grew by 40% YoY. More marketers are reallocating budgets from linear TV to CTV.

- Ad Inventory Shrinkage: As viewers prefer ad-free options and lighter ad loads, the combined ad inventory for both linear TV and CTV is expected to shrink by 6.6% annually from 2023 to 2027.

Reasons for Increasing CTV Ad Spend

- Audience Targeting Capabilities: 47% of marketers increasing their CTV ad spend do so because of their audience targeting capabilities.

- Capturing Declining TV Audiences: 39% of marketers want to capture declining linear TV audiences.

- Detailed Reporting and Insights: 30% of marketers value detailed reporting, measurement, and insights.

- Affordable TV Options: 30% of marketers find CTV and OTT advertising to be affordable options for performance-driven digital marketers.

- Brand Awareness and Performance Goals: 38% of marketers cite the achievement of these goals as the main benefit.

Reasons for Slowing CTV Ad Spend

- Macroeconomic Headwinds: 36% of marketers are not increasing their CTV ad spending and cite macroeconomic headwinds as the reason.

- Expense: 31% of marketers find CTV ad spending too expensive.

- Ad Fraud Concerns: 85% of marketers are concerned about ad fraud in CTV and OTT advertising. Despite these concerns, the industry continues to grow, emphasizing the need for effective fraud prevention measures.

📚 Related article: 5 CTV Advertising Trends in 2024:

Explore CTV’s top 2024 trends you don’t want to miss.

The Future of CTV Advertising: Embracing Change

With more households adopting CTV and viewers spending more time on these platforms, the shift from traditional TV is undeniable. Advertisers are reallocating budgets and exploring new ad-supported models. As CTV grows, it offers a dynamic avenue for reaching diverse demographics, keeping it at the forefront of digital advertising strategies.

Unskippable & Unstoppable Ads

Using our data-driven approach to CTV advertising, take your audience on an unskippable and unstoppable journey that compels them to take action.

About the Author

Kate Meda is a Copywriter at KORTX. She enjoys omitting needless words and making things sound good.