Experiences refined for people

Experiences refined for people

Wanderlust is revitalizing the travel industry.

Amidst this boom, travel advertisers rebounded with post-pandemic vigor, boosting ad spending by 15% in 2023 over the previous year.

Explore these 12 travel marketing trends that illustrate an industry recovering and reimagining its future.

With increasing concerns over privacy and Third-Party cookies’ impending phase-out, travel marketers must rely more on alternative methods like First- and Second-Party data, contextual marketing, cross-device audience targeting, and more.

Below are the top targeting strategies you’ll see to in response to this cookieless trend:

First-Party (1P) data, collected directly from customer interactions, is now the gold standard in travel advertising. This includes data collected through direct interactions, like website visits, app usage, customer feedback, and booking histories.

Travel brands use this data to understand where and how their core customers interact with digital marketing placements.

ID-free targeting combines AI with First-Party data to analyze anonymous digital journey patterns, creating a map to identify the actions of similar website visitors.

Advertisers can tailor their model using their own First-Party data to forecast and choose impression opportunities.

Collaborating with trusted partners to use Second-Party data involves collecting data through deterministic processes like login IDs, providing a more accurate and scalable way to target specific audience segments.

Contextual marketing targets ads based on the content currently being viewed by users, replacing the need for Third-Party data.

Contextual marketing matches ads with the user’s current interests and the webpage’s theme, enhancing relevance and audience engagement.

AI-powered contextual marketing analyzes audience actions in real time to identify engagement patterns, enabling brands to target similar content to new audiences at optimal moments.

Travel marketers should explore and implement cookieless solutions, experimenting with strategies that best align with their brand and audience to stay ahead this year.

Travel marketers must adopt cookieless targeting strategies like First- and Second-Party data, ID-free AI, and contextual marketing to achieve precise, privacy-compliant audience engagement.

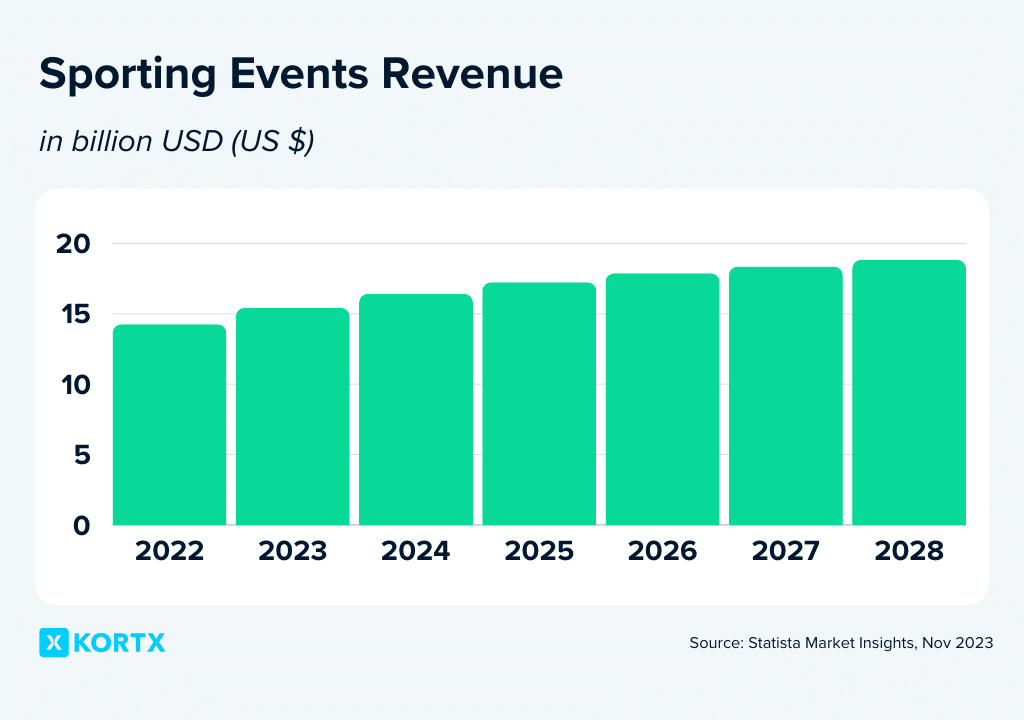

Sports tourism will continue to surge in 2024, fueled by high-profile events like the Paris Summer Olympics, the FIFA World Cup, March Madness, and the Super Bowl, where tourists book travel tickets at least a year in advance.

The appeal of sports tourism is growing due to new tournaments and a rise in women’s sports participation, including events like the Women’s Big Bash League and the women’s edition of the Indian Premier League.

Increased government funding, initiatives to promote sports tourism, and a rise in young athletes are also major influences.

Travel marketers can take full advantage of this surge by integrating strategies, such as advanced TV advertising strategies like Connected TV (CTV) and Picture-in-Picture (PiP) (a type of interactive CTV) advertising, as well as advertising on Free Ad-Supported Streaming TV (FAST) channels.

PiP allows viewers to watch live sports and other content, allowing travel brands to present appealing packages during these events.

Sports tourism’s rising popularity, driven by major events like the Paris Olympics and increased women’s sports participation, presents a significant opportunity to use advanced advertising strategies and tap into this growing market.

Integrating traditional blog posts with concise, visually engaging video content on platforms like TikTok and Instagram greatly enhances a brand’s reach and website traffic potential.

TikTok’s user growth–approximately eight new users every second–highlights video content’s potential to reach a broad audience. This trend isn’t lost on travel companies, which they use to engage customers better.

Video content for travel marketing serves multiple purposes:

Online video (OLV) and Connected TV (CTV) have also opened new avenues for reaching families and larger audiences, especially using cross-device targeting.

For example, a family watching a Royal Caribbean cruise ad on CTV is later targeted with personalized smartphone follow-up offers, enhancing engagement and allowing travel marketers to track the ad’s effectiveness across multiple platforms.

TikTok has transformed travel guides, with videos replacing traditional blog posts as the go-to source for travel inspiration and information.

Since 2021, TikTok has seen a staggering 410% increase in views of travel content, with 71% of European users likely to book a holiday based on TikTok recommendations.

🌴 TikTok Made Me Travel There 83% of Spanish users would consider a travel product or activity after seeing it on TikTok.

TikTok’s community craves content that stirs wanderlust, showcasing unique destinations and experiences.

TikTok’s community craves content that stirs wanderlust, showcasing unique destinations and experiences.

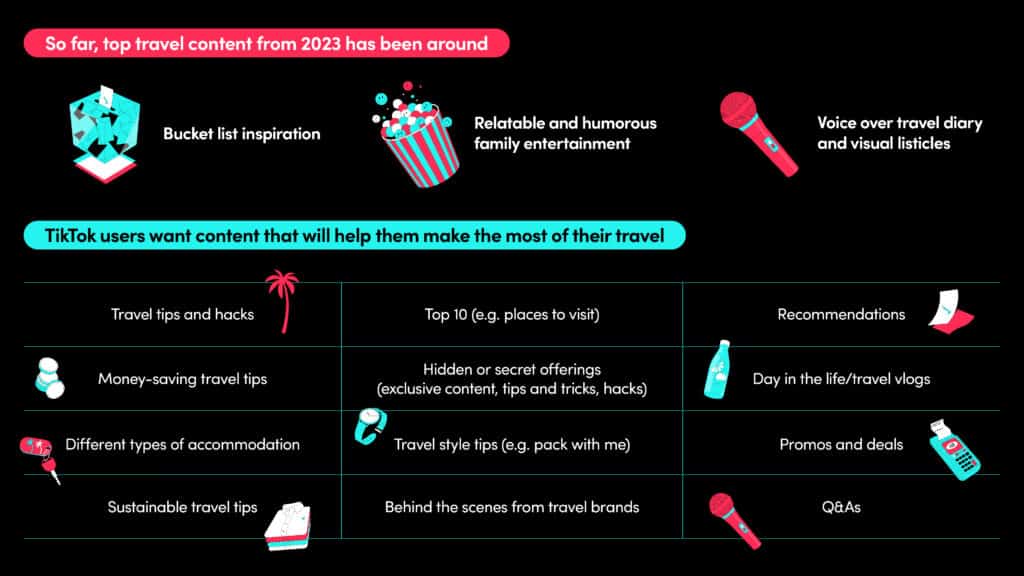

TikTok’s findings on the top travel content for 2023.

Travel brands should align their content strategy with the top emerging TikTok travel trends and user preferences, such as:

Adapting to these trends, travel brands can inspire, engage, and connect with a travel-enthusiastic audience.

TikTok is a prime platform for travel inspiration and recommendations. Travel brands should align their content with emerging TikTok travel trends like luxury, domestic, and sustainable travel to engage younger audiences effectively.

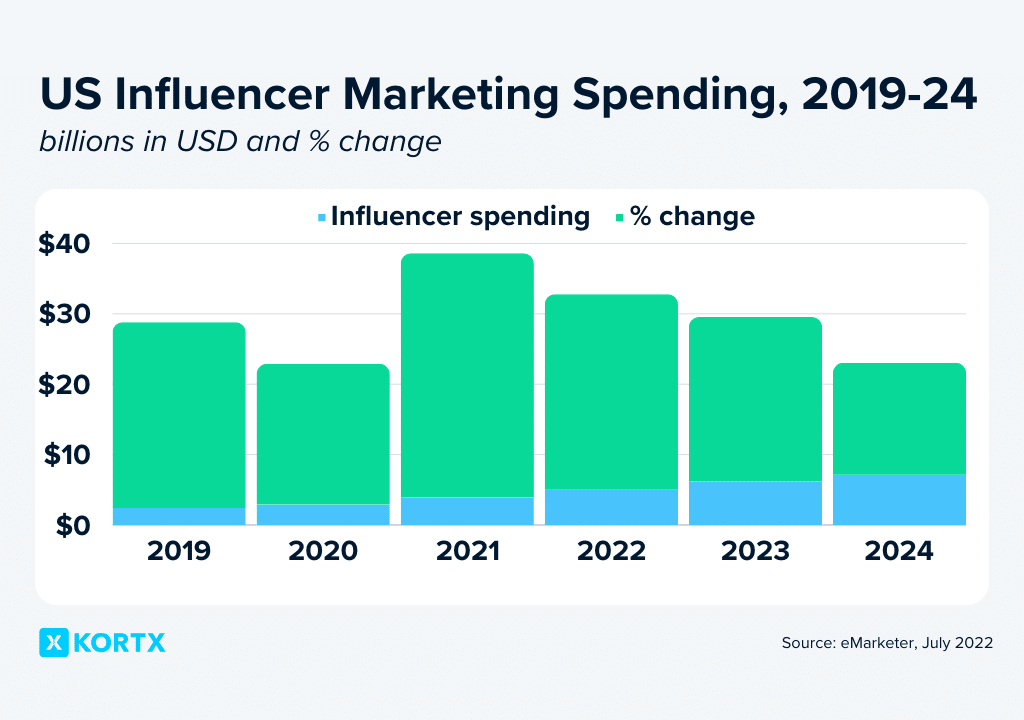

According to a MediaRadar report, as major travel categories (e.g., airlines, lodging, rental car companies) ramp up their marketing efforts, a substantial portion of their budgets is allocated to partnerships with creators and influencers.

Influencers, with their large followings and ability to generate authentic content, offer a personal touch and a sense of trust that traditional advertising channels often can’t match.

Local influencers help draw their following to restaurants and other locations in the area.

@gracietravels i bet you didnt know about these! 🫣 ✈️ #travelhacks #traveltiktok #travelfyp #travellife #traveltips #travelhack #traveltok

Gracietravels shares helpful dos and don’ts for various exotic locations.

As travel marketing continues to surge, much of marketing spending will likely go to creator partnerships, increasing total influencer marketing spending.

Influencer marketing is returning, particularly on TikTok, with significant budgets allocated by major travel categories for partnerships with creators who offer authentic and trustworthy content.

Ecotourism focuses on travel experiences that preserve and sustain natural environments while improving the welfare of local populations.

A lust for more outdoor travel experiences, urbanization, and affordable flight availability primarily drives ecotourism’s popularity. Generation Y (millennials) dominates ecotourism, with 60% of the share and spending $200 billion on travel.

For example, #SustainableTravel boasts 78.1 million views, and #EcoTourism garnered 72M views on TikTok.

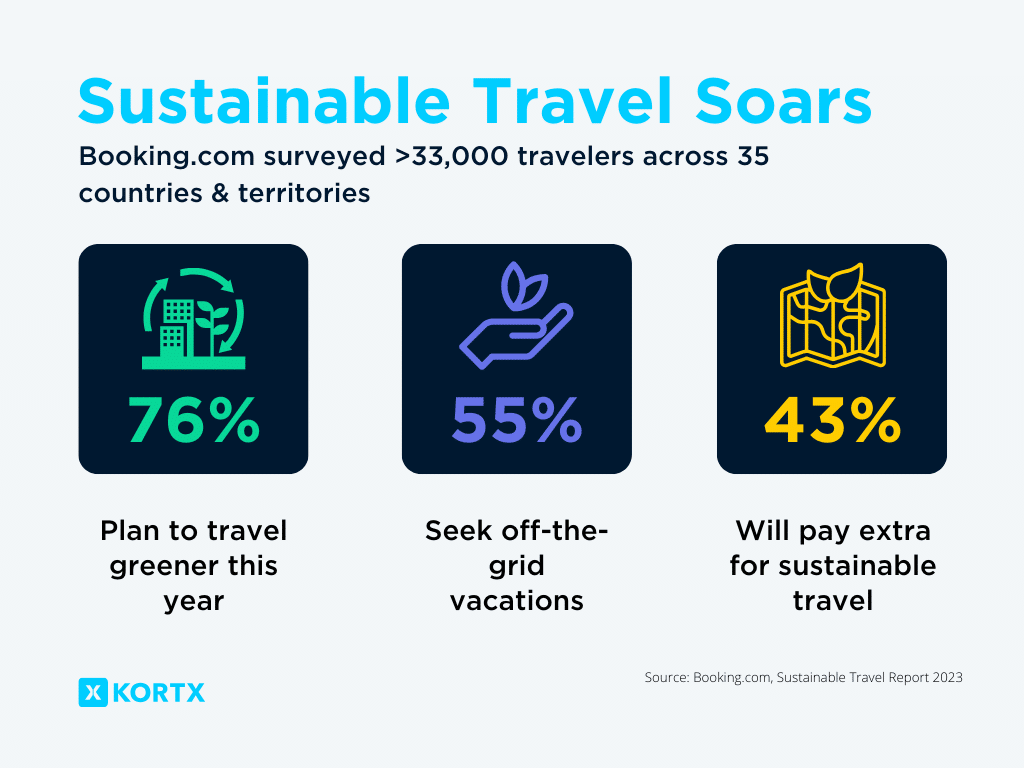

Booking.com found that 76% of survey respondents planned to travel greener, up 15% from 2021. 55% of travelers seek off-the-grid vacations for escapism, with 44% preferring simpler travel experiences.

Hotels are increasingly committing to go carbon-neutral by 2050 or earlier to appeal to eco-conscious travelers. The Brutalist-style Hotel Marcel Hilton in Connecticut is the first net-zero carbon emissions hotel in the United States.

Travel marketers can tap into these younger generational and eco-conscious segments by focusing on eco-friendly and unique travel experiences in their campaigns.

Ecotourism is on the rise, driven by the popularity of outdoor travel experiences and younger generations like Millennials and Gen Z. Travel marketers can cater to eco-conscious travelers by highlighting sustainable initiatives.

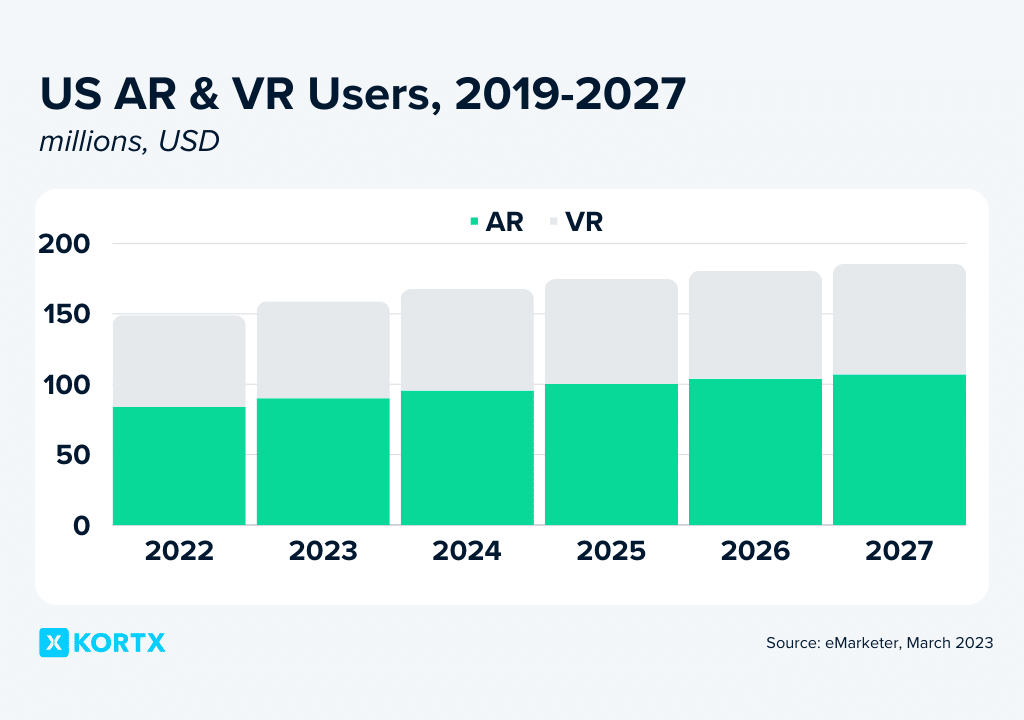

As VR technology becomes more sophisticated and accessible, it opens up new opportunities for consumers and advertisers.

Innovative services like Discover Live and Wowzitude, are offering interactive virtual vacation tours, allowing users to experience destinations before they decide to visit them in person.

Companies like Meta are enhancing the VR experience, with products like the Oculus headset offering virtual tours of world-renowned sites, such as the reconstruction of Notre Dame.

Platforms like Renderverse and Avatour provide VR-based real estate and travel tours, allowing users to explore properties and destinations remotely.

The VR space also opens up the potential for partnerships and sponsorships. For instance, theater groups could secure corporate sponsorships by integrating ads into their VR performances.

Despite its growing popularity, VR technology is still evolving. Users want high-quality, real-time experiences to share with friends, pushing the boundaries of current VR capabilities.

Virtual reality (VR) technology offers immersive virtual tourism experiences and advertising opportunities, driven by innovative services and products, but the demand for high-quality, real-time VR experiences continues to challenge its growth.

Advanced AI models like Google’s Gemini signal a trend toward AI-generated content rich in quality and relevance. Gemini can understand diverse formats like text, images, and even audio.

Google’s Search Generative Experience will integrate diverse content formats like videos, web stories, and podcasts in SERP (search engine results pages) optimization to directly engage users from the search results. A consistent and diversified presence across these channels can help travel brands capture more organic traffic, complementing paid search strategies.

For travel marketers, the increasing need for personalized, localized, and experiential local strategies signifies a shift towards creating more immersive and region-specific content.

Create content that resonates with the local culture and experiences. This includes local posts, stories about the area, and highlights of unique local attractions.

In the AI age, travel marketers should prioritize creating immersive and localized content to enhance SEO and engage users effectively.

Travelers have a growing demand for travel apps, with the industry witnessing a 53% increase in the last year.

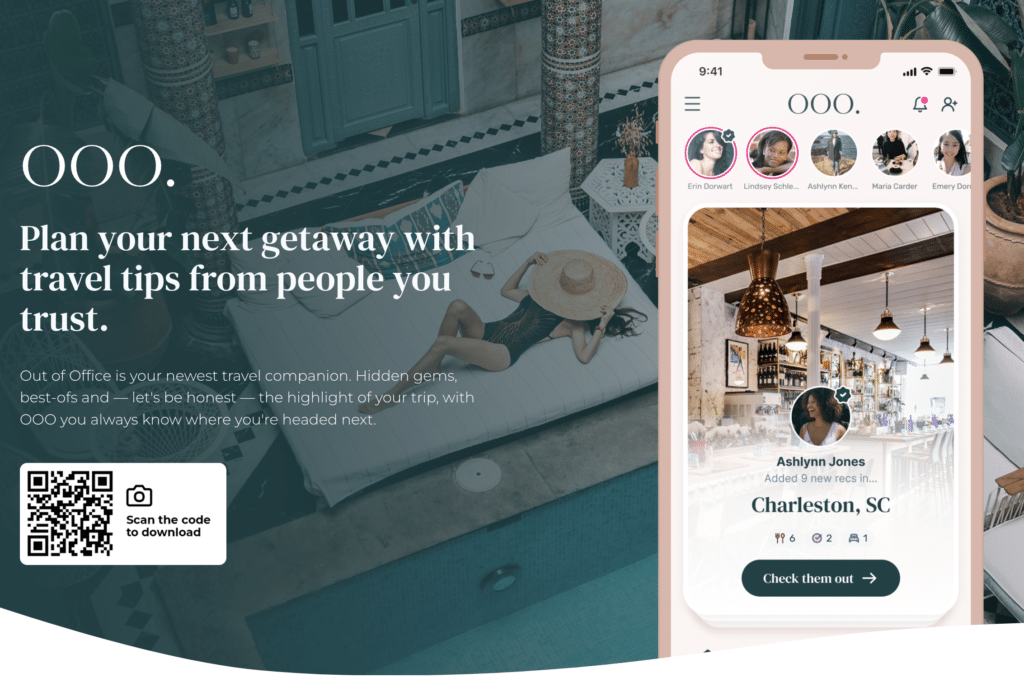

These platforms serve as digital travel agencies, offering a seamless interface for managing bookings, accommodations, and activities. They offer convenience without juggling various booking sites and the fear of falling into tourist traps or overpriced services.

As digital tools for trip planning become more popular, opportunities in marketing partnerships, targeted ads, and direct customer engagement grow. Booking.com leads with its intuitive design and broad booking capabilities.

Meanwhile, niche apps like TakeMeOutOfOffice, Brevity, and LetsBatch cater to unique travel needs, offering specialized services for leisure breaks, business trips, and group travel, respectively.

Despite financial prosperity, with bookings hitting unprecedented highs and the company celebrating its first full profitable year in 2022, Airbnb confronts a mix of discontent from guests, hosts, and cities alike.

Issues range from the platform’s rising costs to the mismatch between online portrayals and actual accommodations, alongside stringent regulations from cities aiming to curb short-term rentals.

Airbnb listings surpass available apartments:

Airbnb’s growing challenges, including rising costs, regulatory pressures, and guest dissatisfaction, are driving a noticeable shift of some travelers back to traditional hotels.

Skyrocketing rental car prices were a popular frustration during pandemic-era travel stories, hitting record highs in July 2021. Turo, a peer-to-peer car-sharing platform, allows car owners to rent their own cars to regular people, like an Airbnb for cars. The global car-sharing market surpassed $2 billion in 2020 and is expected to grow at least 20% annually through 2027. Taking advantage of the industry’s growth, other companies like Getaround and Car Shair are quickly following. These platforms cater to a growing consumer demand for more accessible, cost-effective, and flexible car rental options. Whether or not it will face the same fate as Airbnb is yet to be decided, though it is certainly challenging traditional rental agencies.

The rise of peer-to-peer car rental platforms signifies a transformative shift towards economical and personalized transportation options, challenging traditional rental models.

A staggering 88% of travelers desire nostalgic getaways that hark back to yesteryears—be it visiting locations of retro film fame or opting for bus travel reminiscent of school excursions. 23% of travelers, including millennials and Gen Z who have not experienced it firsthand, are yearning for pre-digital charm, seeking an escape to a simpler time. This sentiment is fueling interest in popular destinations in the ’80s and ’90s, such as Budva in Montenegro and Bolzano in Italy, both trending locations in 2023. Furthermore, family travel is evolving, with 54% of respondents planning multi-generational trips or “family reunion” vacations.

There’s an increasing demand for nostalgic travel and multi-generational family trips. Offering competitive Child Rates is a strategic move to capitalize on this trend. Such initiatives can potentially boost family bookings by 15% on average.

The shift towards cookieless advertising, the rise of sports tourism, the dominance of video content, and the growing influence of platforms like TikTok and VR technology are redefining how travel brands engage with their audiences. With a stronger focus on eco-tourism and the integration of AI in SEO strategies, travel marketers are poised to deliver more personalized, immersive, and sustainable travel experiences. Adapting to these trends will help travel brands stay ahead in a competitive market and meet diverse traveler needs around the globe.

Erik Stubenvoll is a Managing Director at KORTX with over 20 years of experience. When he is not learning about his client’s goals, he is on the sidelines with his wife at his daughter’s softball and soccer games or on the golf course.

From us to your inbox weekly.