Marketers must be ready for a longer, unpredictable retail calendar, a spike in deal-hunting, and growing interest in social and video channels.

This unexpected mix of events offers marketers countless opportunities and potential missed moments within a fleeting four-month window. Major events like the Summer Olympics, a heated presidential election, and a shortened shopping season converge at the tail end of 2024.

Key Holiday Spending Statistics 2024

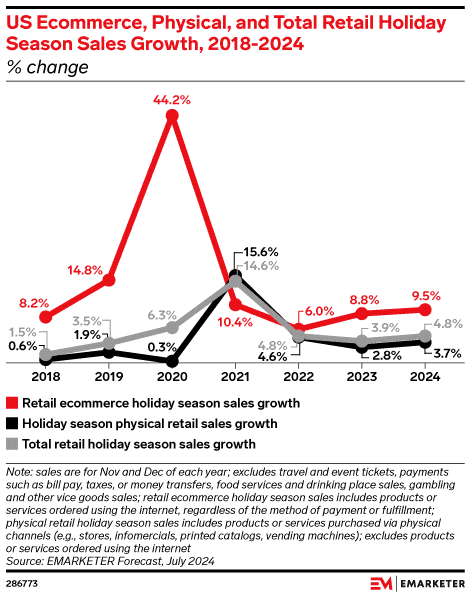

Holiday ecommerce will continue to play a significant role in consumer spending, with a growing emphasis on convenience, affordability, and global access. The year will close on a strong note as consumers maintain steady spending, even amidst economic uncertainty.

- $271.58B: Predicted US holiday ecommerce sales for 2024, up 9.5% from 2023.

- $222.1B: Record online holiday sales in 2023, a 4.9% increase from the previous year.

- $16.6B: Spent using BNPL in 2023, marking a 14% year-over-year rise.

- 63%: Consumers in Western countries plan to shop via Chinese apps for the 2024 holidays.

- 66%: Consumers delaying major purchases until Cyber Week for better deals.

📄 Table of Contents

- Adapting to Shifting Shopping Timelines: Shoppers are starting very early.

- Personalization & Loyalty: Customers love when brands go the extra mile.

- Shipping & Fulfillment: Price sensitivity is important, but so is convenience.

- The Evolving Role of Ecommerce & Mobile: Mobile shopping is thriving.

- CPG & Grocery: Food & beverage is the top holiday ecommerce category.

Adapting to Shifting Shopping Timelines

Online shopping’s convenience has reshaped the holiday season, kicking off as early as October.

1. The early bird catches the best deals (in early October).

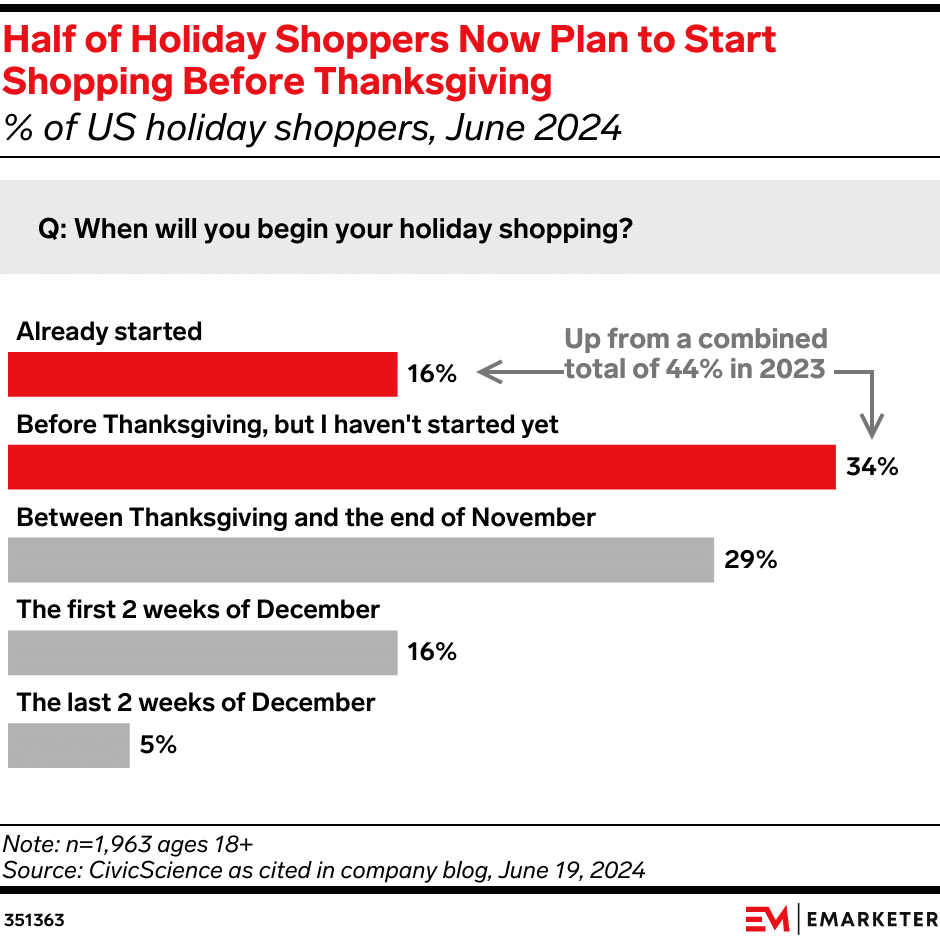

While the holiday season usually peaks in November and December, with big events like Thanksgiving, Black Friday, and Cyber Monday, early October sales are becoming a permanent fixture. Nearly half of consumers now begin their holiday shopping in October or even earlier.

This 2024 holiday shopping trend is primarily due to:

- A Shorter Retail Period: Thanksgiving falls on November 28, 2024, leaving a shorter-than-usual window for shopping and marketing between Cyber Monday and Christmas.

- Supply Chain Concerns: Lingering effects from the pandemic prompt early purchases to avoid delays.

- Retailer Strategies: Like Amazon’s Prime Big Deal Days, early sales events encourage others to follow suit.

- Price Sensitivity: Economic pressures make consumers more deal-conscious, leading to early shopping for promotions.

- Presidential Election: The November 5, 2024 election may impact spending, prompt earlier shopping, distract from holiday marketing, and affect inventory and prices.

How will political ads impact the overall advertising landscape in the lead-up to the 2024 presidential election?

“In 2024, political ads will raise CPMs and create inventory shortages, especially in swing states and on CTV platforms.

Ads placed next to negative political content or misinformation also pose a risk. Advertisers should place their ads in premium, non-divisive environments, like Netflix which banned political advertising, and consider shifting spend to platforms that avoid political ads.”

💡 KORTX Recommendations

- Start Promotions Early: Launch holiday campaigns in September to capture early shoppers.

- Plan Around the Election: Adjust your marketing calendar to accommodate the November 5 election. Get ads on premium, non-divisive channels to protect your brand’s reputation.

- Flexible Media Budget: Allow seasonal and monthly planning while reserving a contingency fund for unexpected opportunities or adjustments.

- Focus on Time-Sensitive Offers: Offer limited-time deals and early bird specials to drive early purchases.

2. Consumers are doing more research than ever.

Mobile searches for “Black Friday deals” shot up over 200% in the past two years.

After the holidays, searches for “gifts” and “presents” also spiked—January 2023 saw a 45% and 15% increase compared to September and October. This proves there’s year-round demand, and businesses can keep sales rolling long after the holiday season.

💡 KORTX Recommendations

- Strengthen SEO: Optimize your website and product listings for relevant keywords to improve organic visibility in search engine results.

- Inform Customers: Create valuable and engaging content, such as gift guides and blog posts, to attract and inform potential customers of ongoing deals, promotions, and more.

- Leverage PR: Secure media coverage and product reviews to increase brand awareness and build credibility.

3. Don’t treat Black Friday as a single-day event.

Many businesses aim to engage customers for the entire holiday season. They use a two-part strategy: start with early and consistent ads to attract new customers, then follow up with targeted retargeting.

MNTN’s two-part strategy in 2023—early prospecting combined with targeted retargeting—led to a 19% higher return on ad spend, 41% more impressions, and a 177% increase in revenue.

💡 KORTX Recommendations

- Start Early & Stay Consistent: Launch prospecting campaigns early to build awareness and capture new customers. Maintain this cadence throughout all of Q4.

- Use Precise Retargeting: Re-engage interested customers to keep them moving toward a purchase.

- Optimize with Data: Monitor and adjust campaigns to maximize return on ad spend and conversions.

What motivates you when it comes to holiday shopping, given your busy schedule?

“Between working full-time and raising 2 kids with jam-packed schedules, I love online shopping after the kids go to bed. I try to shop in advance every year but always come close to the deadline. Confidence in a retailer’s fast (free) shipping and last-minute deals motivates me. I typically reserve in-person shopping for items that won’t ship in time or grab last-minute deals to supplement what I have already purchased online.”

Personalization & Loyalty

Standing out requires understanding your customers’ preferences. Personalization and loyalty programs are essential for building lasting relationships and driving repeat business.

1. Personalization & loyalty programs can win over customers (& AI can help!).

83% of consumers crave personalized offers, but only 44% find them relevant—leaving a big gap for retailers to fill.

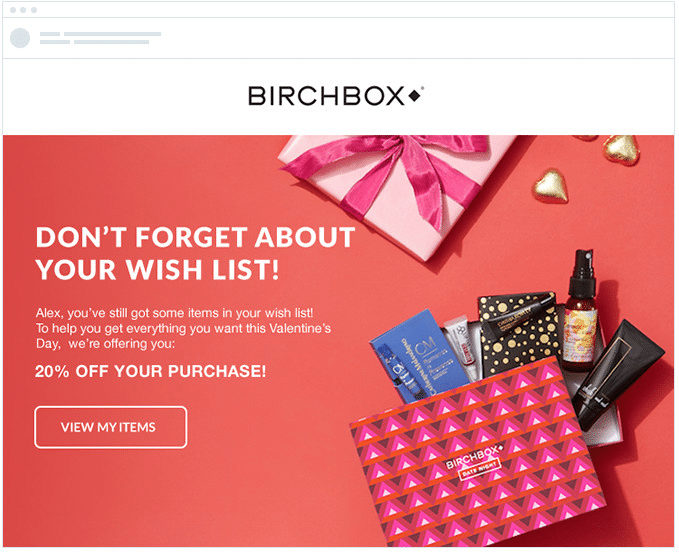

Almost a third of U.S. adults love “wish list” features. They make it easy for shoppers to save, organize, and share what they’re considering, making the whole experience more convenient and personalized.

Birchbox gets it. They offer a wish list feature and sweeten the deal with 20% off when customers use it.

Loyalty programs are key to retaining customers. Exclusive discounts, early access, and rewards points give shoppers a reason to stick around. The numbers back it up: 60% value loyalty points, and 63% will spend more when perks are involved.

Retailers can also boost the customer experience with AI-driven tools like personalized recommendations and chatbots. With 53% of customers open to AI gift suggestions, personalized experiences are taking over fast.

💡 KORTX Recommendations

- Prioritize Personalization: Focus on using first-party data to deliver the personalized experiences customers demand.

- Leverage AI: Use AI tools like personalized recommendations and chatbots to enhance the customer experience and drive product discovery.

- Boost Loyalty Programs: Build and promote loyalty programs to lock in repeat purchases and keep customers loyal.

2. Inflation is pushing consumers to be more budget-conscious.

61% of consumers say they can’t afford a wrong purchase this holiday season. The success of low-cost apps like Temu and Shein reflects this budget-conscious trend, with 69% of retailers expecting the demand for discounts to continue.

To meet this demand, retailers should shift from flash sales to consistent, sitewide discounts of up to 30%. Retail Dive found that 84% of retailers saw increased profitability, likely due to effective promotions.

💡 KORTX Recommendations

- Offer Consistent Discounts: Prioritize sitewide discounts up to 30% over flash sales to appeal to price-conscious shoppers.

- Highlight Value: Market your competitive pricing to align with consumer demand for affordable options.

- Optimize Promotions: Use AI and predictive analytics to personalize offers and reach customers when they’re most likely to buy.

🦌 Got last-minute ad dollars to spend?

KORTX can activate campaigns in 48 hours.

Shipping & Fulfillment

Amazon has set the bar for fast shipping. Customers now expect it from all retailers, even if it means paying a premium.

1. Price sensitivity is important, but so is convenience & affordability.

Free shipping is still a big driver, with over half of shoppers more likely to buy when it’s offered.

But rising shipping costs are a problem. Retailers who don’t want to pass those costs on need to find a balance between eating some of it and offering fast, reliable delivery to stay competitive.

💡 KORTX Recommendations

- Highlight Free and Discounted Shipping: Absorb some shipping costs to meet consumer expectations, such as offering free shipping over a certain amount.

- Encourage Alternative Fulfillment: Promote options like in-store pickup and consolidated shipping to reduce costs.

- Promote Expedited Shipping: Feature fast shipping options prominently, even if they come with an adjusted price.

- Ensure Transparency: Clearly communicate shipping costs and delivery times to manage customer expectations effectively.

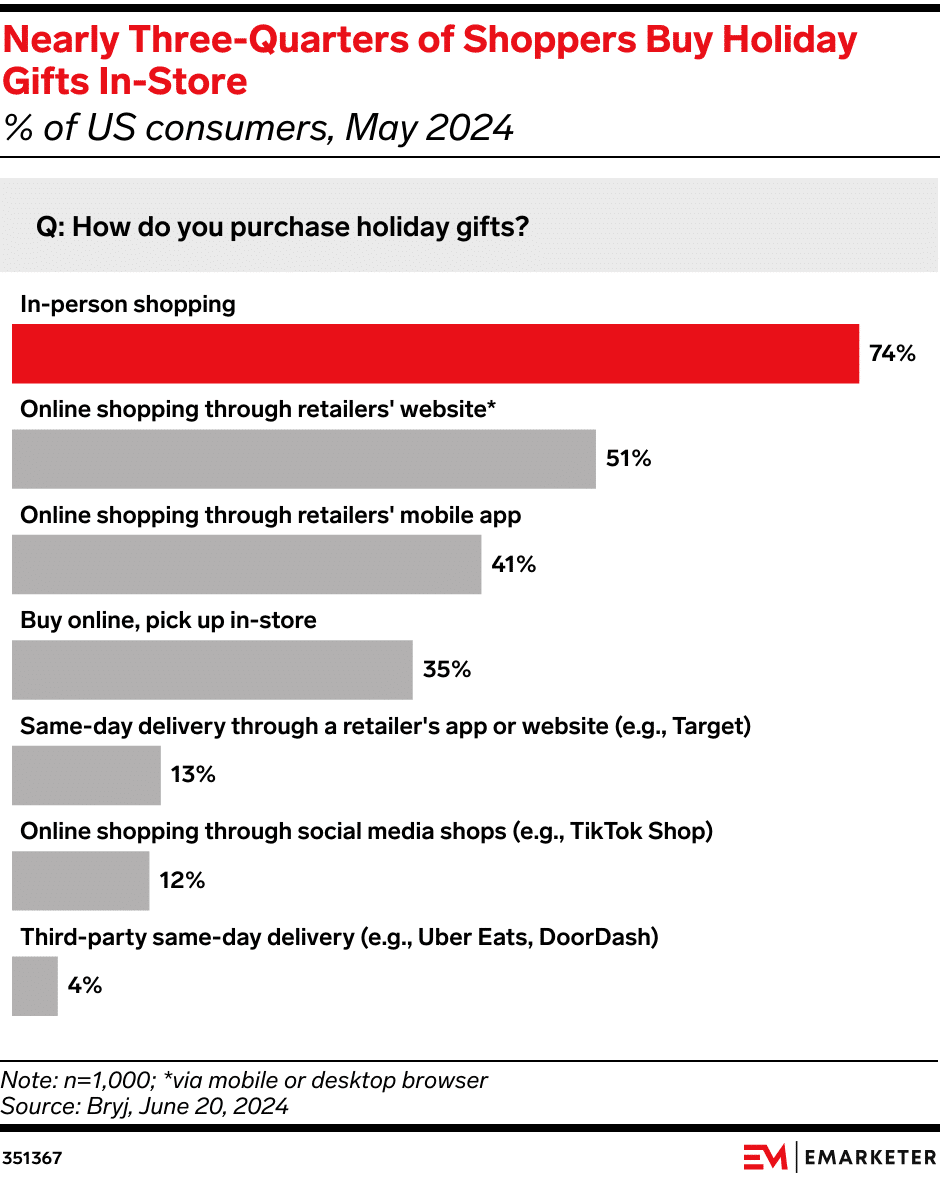

2. As ecommerce outpaces physical retail, an omnichannel strategy is essential.

Around 49% of consumers prefer a mix of online and in-store shopping. Retailers must create a seamless experience across online, in-store, and mobile platforms to meet customer expectations.

Retail executives have observed significant growth in fulfillment channel usage, with 83% reporting increased home deliveries and 81% noting a rise in ‘ship from store’ orders.

💡 KORTX Recommendations

- Connect Fulfillment Channels: Seamlessly link online, in-store, and mobile experiences for easy customer transitions and flexible delivery options.

- Boost In-Store and Online Synergy: Offer services like ‘buy online, pick up in-store’ (BOPIS) and ‘ship from store’ to meet customer demands for convenience.

- Personalize with Data: Use customer data to tailor offers and recommendations based on their shopping habits and delivery preferences.

3. Buy Now, Pay Later (BNPL) is booming.

U.S. shoppers spent $16.6 billion on BNPL in 2023, up 14% from last year. This growth is fueled by tighter credit, rising adoption among Gen X and baby boomers, and new use cases.

Early holiday shoppers are jumping on board, with 31% using services like Affirm, Afterpay, and Splitit in 2023.

💡 KORTX Recommendations

- Implement BOPIS (Buy Online, Pay in Store): Highlight BOPIS options in holiday messaging, partnering with brands like Target and Walmart to appeal to last-minute shoppers.

- Integrate BNPL: Offer BNPL services to attract budget-conscious consumers, especially during the holidays.

- Highlight BNPL in Marketing: Promote BNPL options to capture early holiday shoppers.

What role does “buy online, pick up in store” play in the shift towards digital sales channels?

“Both consumers and retailers are pushing the growth of buy online, pick up in-store (BOPIS). This shift means less in-aisle browsing, with sales—and product discovery—going digital. Physical store placement matters less, while digital visibility becomes key. For our clients breaking into their category, this is a chance to get ahead of where the market is heading.”

The Shift in Ecommerce & Mobile Holiday Shopping

1. Mobile-centric shopping (mcommerce) comprised over 50% of online sales in 2023.

On Christmas Day, 63% of online sales came from mobile devices, showing the growing ease of phone-based shopping, even for last-minute gifts.

Mobile has overtaken desktop as the preferred shopping mode, with platforms like Temu and Shein thriving due to their mobile-first approach.

💡 KORTX Recommendations

- Optimize for Mobile: Ensure your online store is mobile-friendly with easy navigation, fast load times, and a streamlined checkout process.

- Review and Optimize: Analyze customer data to refine experiences and use cross-device tracking for consistency.

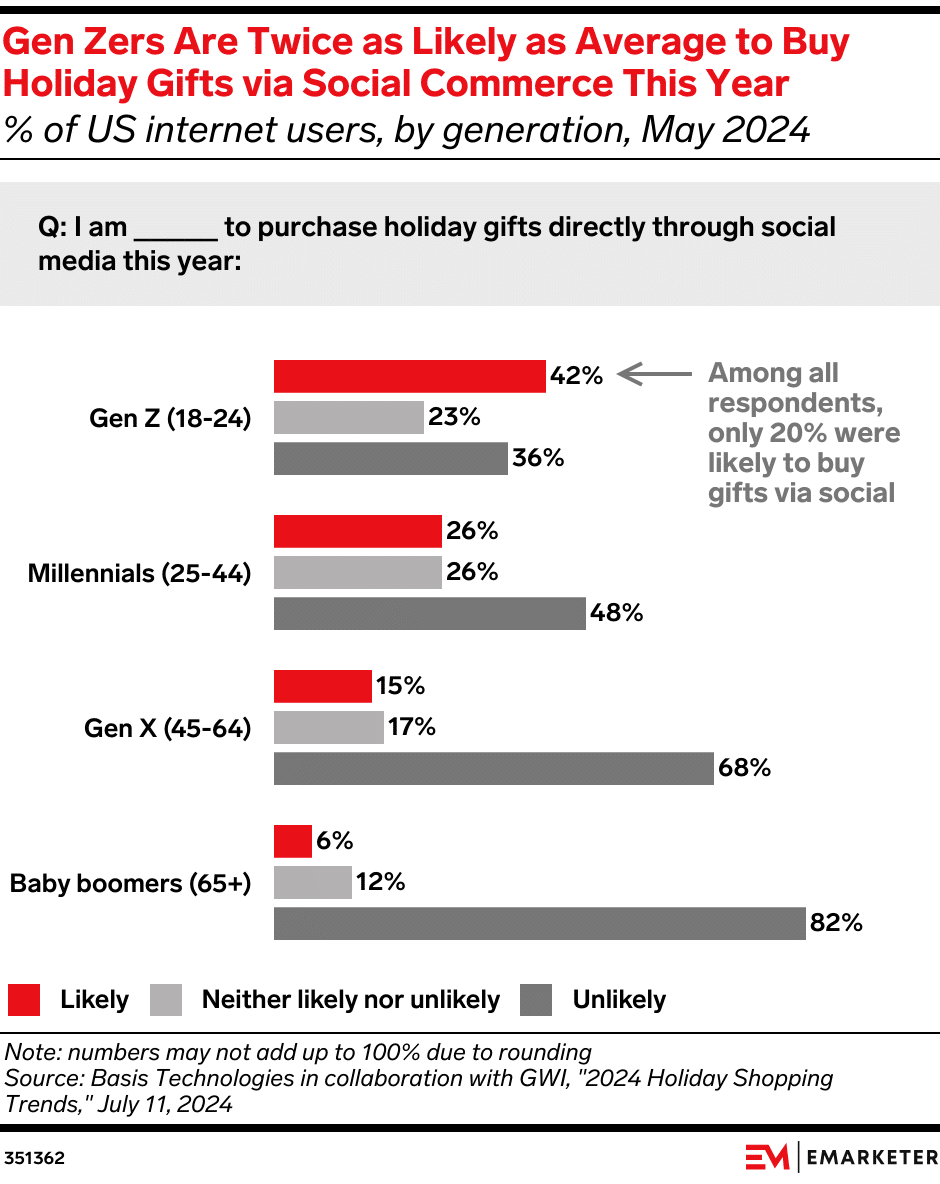

- Leverage Social Commerce: Target Gen Z with integrated social media strategies on social media platforms.

2. Social commerce is rapidly growing, fueled by younger generations.

Platforms like TikTok, Instagram, and YouTube are key hubs for product discovery, with 54% of Gen Z, 45% of millennials, and 27% of Gen X using them for holiday gift inspiration.

However, while social commerce excels at discovery, many consumers still prefer to finalize purchases on traditional ecommerce sites or in stores. This highlights the need for smoother transitions to checkout.

💡 KORTX Recommendations

- Focus on Social Media: Use paid social media advertising to expand your reach and tap into social discovery.

- Simplify the Buyer Journey: Integrate shoppable posts and in-app purchasing features.

- Use Influencer Marketing: Collaborate with influencers who align with your brand to promote products and reach younger demographics.

What role do social media platforms play in driving holiday sales, and how can businesses optimize their social media marketing?

“Social media is one of the closest touchpoints between brands and customers. It lets companies show their personality while guiding users through the entire purchase funnel. With holiday spending on the rise, it’s a prime time to stand out and get in front of your audience. Create content that matches where consumers are in their buying journey, keep pushing content that brings in new eyes, and don’t hesitate to ask for the sale.”

3. Black Friday is quickly turning into “Cyber Friday.”

Shoppers are opting for convenience, better pricing, and the ease of staying home, with 72% now favoring online over in-store shopping.

Still, physical stores aren’t out of the game. They continue to attract those who enjoy the hands-on experience and festive vibe.

💡 KORTX Recommendations

- Optimize Your Website: Ensure your site is fast, user-friendly, and mobile-ready for Black Friday’s online surge.

- Promote Early Deals: Launch digital deals before Black Friday to capture early Cyber Week shoppers.

- Enhance In-Store Appeal: Create a festive atmosphere and offer exclusive in-store deals to attract those who enjoy shopping in person.

4. In-store holiday sales growth will more than double the full-year growth rate.

Many consumers still prefer a hybrid shopping experience, blending online research with in-person shopping for its sensory appeal and festive atmosphere.

Physical stores also serve as fulfillment hubs, with options like BOPIS (Buy Online, Pay In Store) and Ship from Store offering flexibility.

💡 KORTX Recommendations

- Enhance In-Store Experience: Create festive, sensory-rich environments to attract customers.

- Optimize Fulfillment Hubs: Use BOPIS and Ship from Store to boost convenience and in-store purchases.

- Integrate Digital and Physical: Align digital marketing to drive both online sales and in-store visits.

CPG & Grocery: Capitalizing on Holiday Festivities

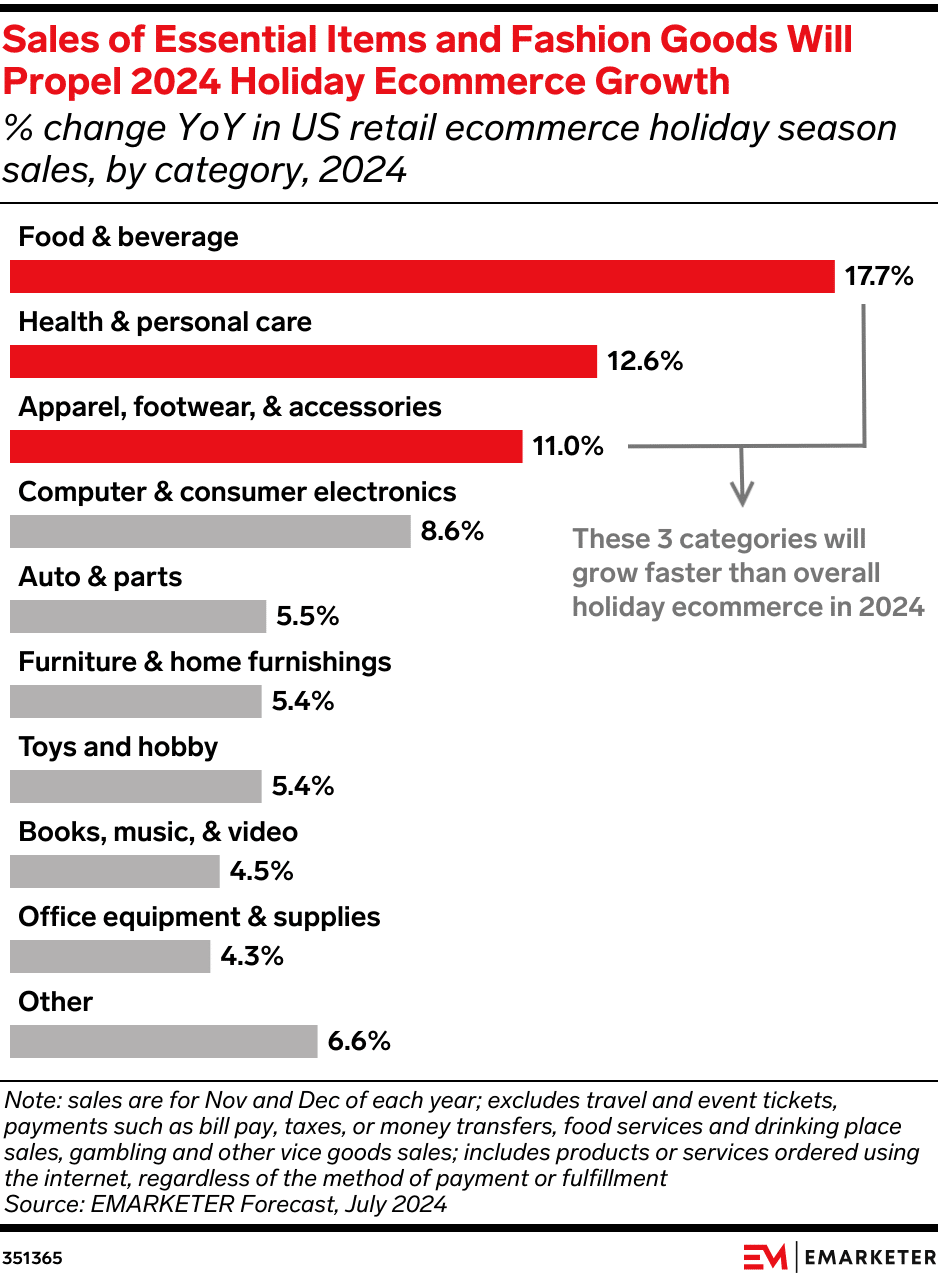

Food and beverage will top holiday retail sales growth for the third consecutive year (+10.0%). CPG brands need strong shelf presence and visibility to capitalize on the increased traffic.

1. Align CPG marketing with early menu planning.

According to Chicory, 29% of consumers plan their holiday menus a month in advance, and 41% plan 2-3 weeks ahead. Timing your marketing campaigns with early menu planning boosts brand visibility and influences purchase decisions for holiday meals.

This is particularly important for grocery stores and big-box retailers, favored destinations for holiday shoppers seeking CPG products.

💡 KORTX Recommendations

- Time Campaigns Strategically: Launch holiday-themed recipes, ingredient bundles, and product promotions in the months before major holidays.

- Focus on Key Retail Destinations: Target grocery stores and big-box retailers with tailored campaigns, as these are the preferred shopping locations for CPG products during the holidays.

- Capture Early Planners: Schedule advertising around the early planning timeline (over a month to 2-3 weeks in advance) to keep your brand top-of-mind.

2. Online recipes provide a key marketing moment.

Online recipes engage shoppers during meal planning. With 85% of consumers using recipes while shopping, brands have a prime opportunity to connect with high-intent buyers.

Contextual, in-recipe ads seamlessly integrate products into relevant content. This can boost both sales and brand recall.

As privacy concerns rise, this strategy offers a data-friendly way to reach targeted audiences effectively.

💡 KORTX Recommendations

- Leverage Contextual Ads: Utilize in-recipe ads to connect with high-intent shoppers during purchase decision-making.

- Prioritize Privacy-Friendly Strategies: Focus on data-friendly, contextual advertising to reach targeted audiences without relying on Third-Party cookies.

- Integrate Product Placements: Seamlessly incorporate your products into relevant online recipes.

3. Holiday celebrations fueling CPG sales.

The holiday season is a prime time for CPG sales, with food and alcohol being the top purchases for holiday celebrations and the top purchase for 2024.

As consumers focus on home entertaining and lower-cost categories, digital sales of food and beverages are set to soar by 17.7% YoY.

💡 KORTX Recommendations

- Boost Holiday Promotions: Align marketing campaigns with key holidays like Thanksgiving and Labor Day to maximize visibility and drive sales.

- Leverage Digital Channels: Focus on digital advertising to capture the growing online demand for food and beverage products during the holiday season.

- Offer Budget-Friendly Options: Highlight affordable products and deals to attract cost-conscious consumers focused on home celebrations.

Sleigh the Holidays with 2024 Trends

As we approach the holiday season, remember that adaptability is crucial. You’ll set yourself up for success by starting early, emphasizing in-store experiences, and engaging customers personally. Here’s to a season of sales prosperity and memorable customer interactions!

Jingle all the way to your bottom line. 📱🎁🎅🎄

Let KORTX sleigh your holiday marketing goals. We craft campaigns that drive engagement, boost brand awareness, and fuel your bottom line.

About the Author

Erik Stubenvoll is a Managing Director at KORTX with over twenty years of experience. When he is not learning about his clients’ goals, he is on the sidelines with his wife at his daughter’s softball and soccer games or on the golf course.