Banking is booming in 2024, with global net interest income projected to reach $8.52 trillion.

Despite economic challenges, banks worldwide are innovating and embracing digital transformation to meet changing customer needs. Traditional banks may grow at an annual rate of 4.92%, reaching $10.83 trillion by 2029.

Explore the key financial marketing trends shaping the present and future of bank advertising in 2024.

What is a top strategy for bank advertising and marketing in 2024?

“Successful marketing for personal finance institutions requires a robust strategy that addresses customers across all digital ecosystems: Search, social, and programmatic. Each of these channels presents an opportunity to deliver relevant and engaging messaging that matches the user’s digital environment and position in the customer journey. Personal finance and banking brands that invest in a coordinated cross-channel strategy will always have a head-start versus its competition.”

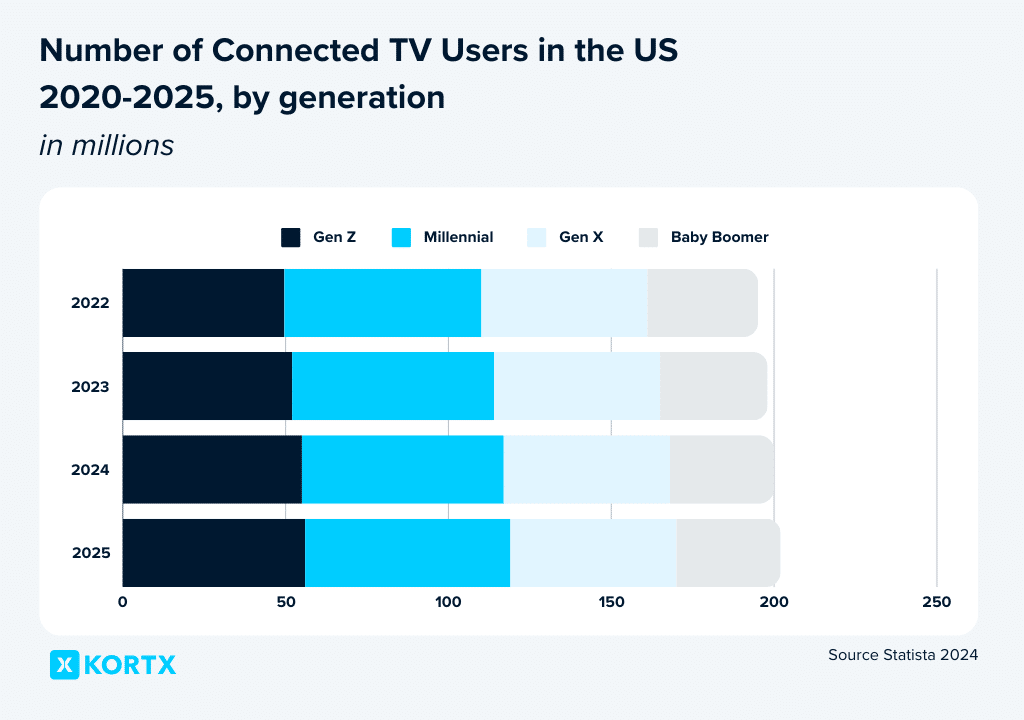

1. Targeting & Retargeting with Connected TV (CTV)

Over one-third of US viewers in every age group own a connected or smart TV.

Financial institutions can target audiences based on search behavior, life transitions, and other detailed factors, moving beyond standard demographics like location and income.

CTV starts as a top-of-the-funnel strategy, creating awareness on the living room TV. It then drives leads down the funnel by retargeting viewers through online video ads, display ads, and other digital formats.

Younger viewers, especially, respond well to CTV’s interactive ad capabilities. Features like QR codes offer a dynamic and engaging experience, increasing brand recall and driving deeper engagement.

💡 Key Takeaway

By combining the extensive reach of traditional TV with the precision of digital targeting, CTV allows financial institutions to connect with and engage every age group throughout the sales funnel.

As CTV technology evolves, we can expect even more sophisticated targeting options and interactive ad formats.

📚 Related article: 40+ Connected TV Statistics to Surprise You in 2024

Review key CTV statistics for 2024, highlighting insights on audience behavior, ad spending, & industry dynamics.

2. Incorporating Programmatic Audio

Audio has overtaken social media, video, and gaming in mobile time spent, making it one of the most effective channels for driving engagement. Digital audio ads offer a screen-free way to reach customers who spend significant time on their mobile devices.

With 89% of Americans using mobile banking channels and 70% considering it their primary way to access bank accounts, financial institutions must prioritize mobile experiences.

Traditional banks and fintechs alike can use music streaming and podcast advertising to help drive brand awareness, boost audience engagement, and ultimately, spur revenue growth.

💡 Key Takeaway

Digital audio ads are essential for financial institutions to enhance brand awareness, engage audiences, and improve customer loyalty, particularly as traditional banks struggle to attract digitally-native Gen Z customers.

3. Inclusive Marketing to Bridge the Banking Divide

Today’s banking system isn’t serving everyone. Low-income households are four times more likely to be “unbanked,” and Black households are 2 ½ times more likely to fall into this category.

10% of Hispanic US households are unbanked, and less than 50% of Latino immigrants have bank accounts. Barriers such as language, high fees, and a lack of nearby branches contribute to this disparity.

How can banks and other financial institutions market to inclusive audiences?

“The American dream looks different for everyone, including how people manage their money. Banks must move beyond a one-size-fits-all approach to truly connect with multicultural communities. At KORTX, we can understand the cultural nuances that shape financial decisions. Banks can develop targeted products, marketing messages, and even branch experiences that resonate with these unique needs. It’s about building trust and demonstrating cultural competency, and that starts with truly understanding the communities you serve.”

Fintech is Booming Among Hispanics

Fintechs are trendy among Hispanics, with 92% using fintech services—the highest proportion in the US. They attract Hispanic customers by offering Spanish-language apps, lower fees, and small-dollar loans, which help improve financial literacy and build credit.

Traditional Banking Needs to Catch Up

Traditional banks face hurdles in serving the Latino community due to discrimination, higher fees, and language barriers. Also, over 20% of unbanked households can’t meet the strict minimum balance requirements.

Latino Community Credit Union has been addressing these issues by serving low-income customers, particularly people of color—through impact investing, bilingual services, and flexible lending practices.

Companies like Square have successfully conducted targeted Spanish-language marketing campaigns.

Asian Americans: Leaders in Digital Banking

Asians are 33% more likely than the average American to use mobile banking apps and invest or trade stocks online. They have 25% higher credit card usage rates and avoid debt beyond loans for their primary residence. However, traditional banks haven’t catered to their preferences for digital tools and resources in languages like Mandarin or Korean.

💡 Key Takeaway

Traditional financial institutions (FIs) can learn fintech with multicultural marketing strategies:

- Spanish Resources: Offering Spanish-language resources, flexible lending options, and addressing data security concerns can resonate with Latino customers.

- More Branches: Increasing branch presence in underserved Black communities so they have greater access to banking opportunities.

- Inclusive Languages: Highlighting digital banking benefits with multilingual marketing for Asian Americans can bridge gaps. Financial inclusion drives long-term growth and success by reaching new markets.

4. Dynamic Creative Optimization (DCO) Saving Time & Money

Dynamic Creative Optimization (DCO) can adapt to reflect continually changing offers, rates, and promotions. Campaigns are always current and responsive to market changes, which is crucial in the fast-paced financial sector.

Varsity Zone’s dynamic HVAC ads offer an ad for heating and another for cooling, depending on the weather.

Localized Campaigns

For financial services with many local agents, DCO enables localized campaigns tailored to regional needs, building stronger connections with local audiences.

Catering to Multicultural Audiences

DCO excels with multicultural audiences by enabling multilingual ads. Advertisers can dynamically tailor ads to different languages and cultural contexts, resonating with Hispanic and Asian audiences.

💡 Key Takeaway

DCO enables personalized, efficient, and real-time adaptable ad campaigns that can save time swapping out ad creatives. These changing ads enhance engagement and conversions across diverse segments.

🔍 Case Study Success: Trustmark Bank Full Funnel Marketing

Discover how we drove a 90% listen-through rate, 98% video completion rate, and a .2% click-through rate through our full-funnel marketing campaign.

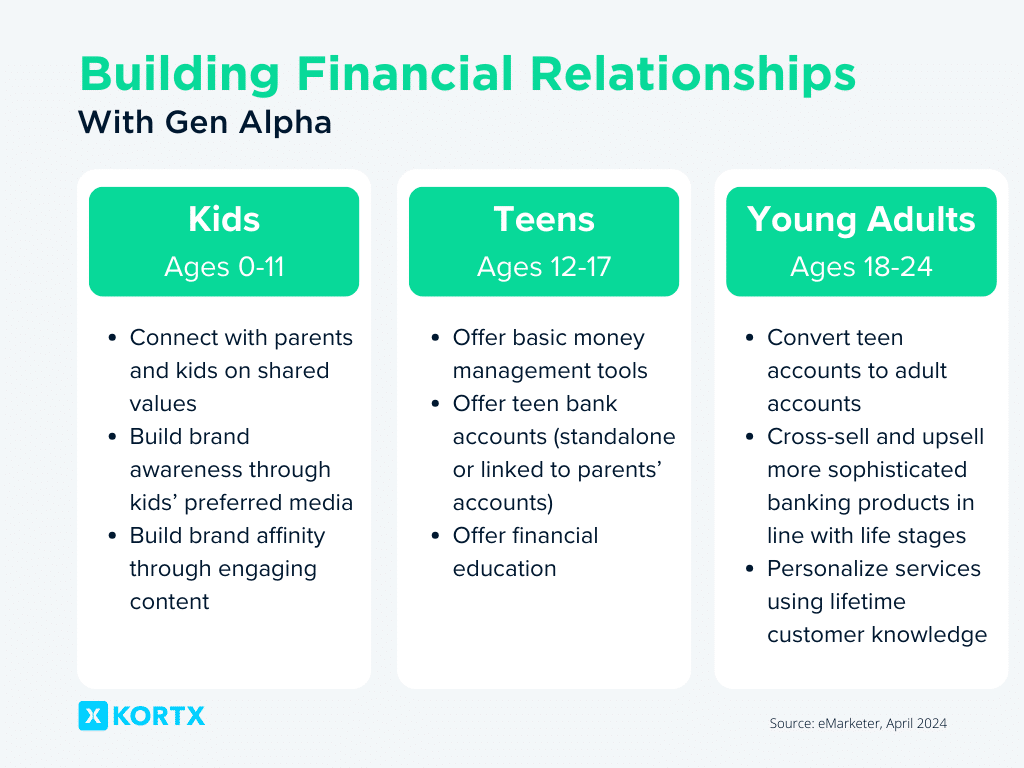

5. Preparing for Gen Alpha with Online Video (OLV) Strategies

With 51% of US children recalling seeing ads recently on YouTube, digital video is a prime arena for banks to forge relationships with Gen Alpha.

Most Gen Alpha parents are millennials who emphasize openness, financial literacy, and social responsibility. Gen Alpha itself values being informed, diversity, authenticity, and social responsibility.

With 80% of US internet users aged 0-11 using tablets and 30% using smartphones, banks will focus strategies on mobile engagement. YouTube for ads, influencer collaborations, and product placements in popular kids’ content can help cater to younger generations.

Banks can also engage Gen Alpha through gamified financial education and interactive social media polls.

💡 Key Takeaway

Gen Alpha is set to become the most populous generation ever, and banks must start laying foundations now to capture these future consumers. Banks should use online video strategies to align with Gen Alpha’s values and convert them into loyal customers in adulthood.

📚 Related article: How to Create Online Video Advertising Campaigns

Review what online video is, recent trends, and how to measure video ads. Offer some examples and expert tips.

6. Digital Banking & Personalization Drive Customer Satisfaction

Hyper-personalization in banking, driven by AI and real-time data, is key to retaining customers and fostering financial inclusion.

72% of customers and 77% of banking leaders see personalization as crucial for retention.

How can financial firms offer personalized experiences for all customers?

“People think personalization and customization are only for sophisticated, ultra-high-net-worth customers. I would argue that everybody wants personalized interactions, and firms should be considering how they can use tech to enable those personalized experiences.”

Also, 70% of companies invest in AI technologies that automatically capture buyer intent signals. This leads to better customer service, enhanced loyalty and satisfaction, and increased revenue from highly individualized recommendations.

Personalization also fosters financial inclusion by opening banking options to traditionally underserved communities.

Companies now use broader data sets beyond FICO scores to personalize financial products for minority groups. By analyzing additional data points like rent, phone, and utility bill payments, fintechs are offering more services to historically underserved segments.

💡 Key Takeaway

Hyper-personalization through AI and real-time data is essential for banks to deepen customer relationships, enhance retention, and promote financial inclusion.

📚 Related article: 8 Insider Bank Marketing Strategies & Tactics (2024)

Discover 8 bank marketing strategies to learn how to adapt to these shifting preferences.

7. Adapting to Gen Z’s Vocational Shift, Savings Habits, & Mental Health Crisis

Gen Z increasingly chooses vocational training over traditional college degrees, with 46% saying college isn’t worth the cost.

One reason behind this shift is their big financial goals, prompting banks to adapt their marketing strategies. At the same time, they’re facing a significant mental health crisis.

By the Numbers

- 23% rise in students studying construction trades.

- Gen Z reports higher mental health struggles (57% feel sad/hopeless) compared to Millennials (36%).

- They are 3x more likely than Baby Boomers to use Buy Now, Pay Later (BNPL) services.

Social media fuels their focus on wealth, but they may need guidance to navigate financial tools. Mental health challenges lead to emotional spending, with many prioritizing fun over saving. This increases the need for financial education to help them achieve their goals.

Gen X is Also Struggling with Financial Literacy

Gen Z’s issues also impact Gen Xers, who are already far behind other generations in saving goals. The median retirement savings account balance for Gen Xers is $10,000, and 40% have no retirement savings.

Gen X is half as likely to seek financial advice from banks and less likely to discuss money with family and friends compared to Gen Z. As a result, Gen X often navigates financial stressors alone without a realistic path toward savings and retirement goals.

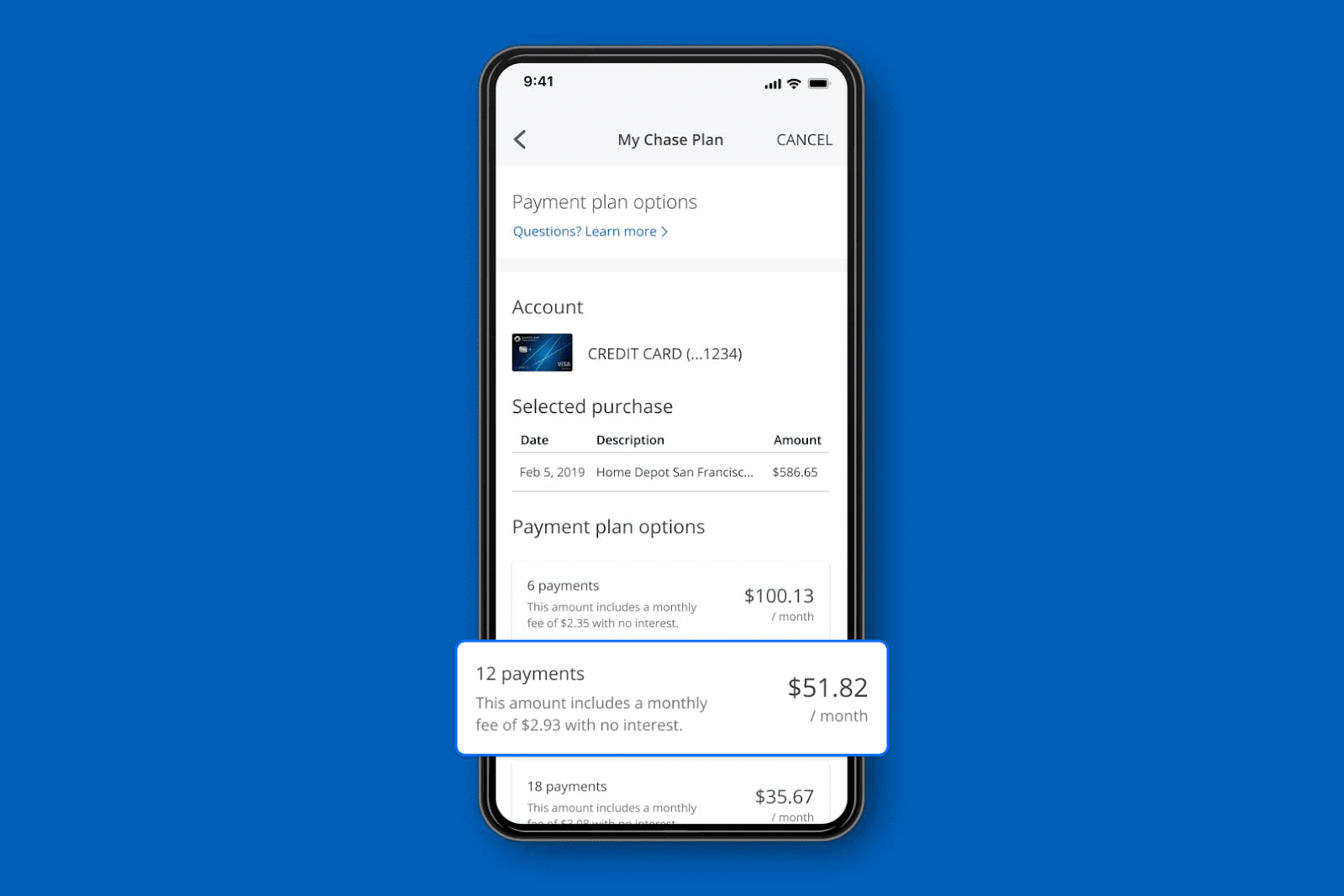

Banks can cross-market solutions by integrating embedded finance options like Buy Now Pay Later (BNPL) services with budgeting apps. When offering BNPL, banks can bundle it with tools like an app that tracks spending, set saving goals, and send alerts on spending limits.

💡 Key Takeaway

Gen Z and Gen X’s financial habits demand updated communications and marketing tactics.

- Avoid Automated Higher Education References: Financial institutions (FIs) that automatically reference higher education in their marketing risk alienating Gen Zers who have chosen different paths.

- Assume a Drive to Save: Instead of focusing on budgeting advice for student loan payments, FIs should assume Gen Zers are driven to save and feel “financially healthy.”

- Offer Tailored, Automated Solutions: FIs that provide tailored, automated solutions to help Gen Zers save money and measure financial success meaningfully should consider partnering with a financial influencer (finfluencer) like Taylor Price to spread the word.

- Educate Gen Z & Gen X on Spending Habits: Use data on user spending and saving habits to provide realistic financial comparisons on their banking account page, helping them understand their spending patterns.

8. Avoiding “Cringe” Messaging to Connect with Gen Z & Millennials

Due to outdated marketing strategies, financial institutions (FIs) struggle to connect with Gen Z and Millennials. Embracing AI and understanding their preferences can bridge this gap.

Current Challenges in Marketing to Younger Generations

- Outdated Messaging: Banks often communicate as if all customers are baby boomers, failing to recognize Gen Z’s preference for less formal, bite-sized, or emotional messaging.

- Platform Mismatch: Banks prioritize traditional platforms like Facebook and Google, while Gen Z and Millenials prefer TikTok, Instagram, Snapchat, and YouTube.

- Social Media Influence: Many Gen Zers and millennials experience “money dysmorphia,” a feeling of financial insecurity induced by their social media feeds.

- The TikTok Economy: A TikTok ban would disrupt the creator economy, impacting content creators’ income and potentially reducing banking customers’ deposits.

How Banks Are Addressing the Issue

Marketing agencies are assisting big banks like Chase, Ally Bank, and SoFi in crafting outreach strategies that resonate with younger audiences. AI helps personalize and adapt messaging to Gen Z and Millennial preferences.

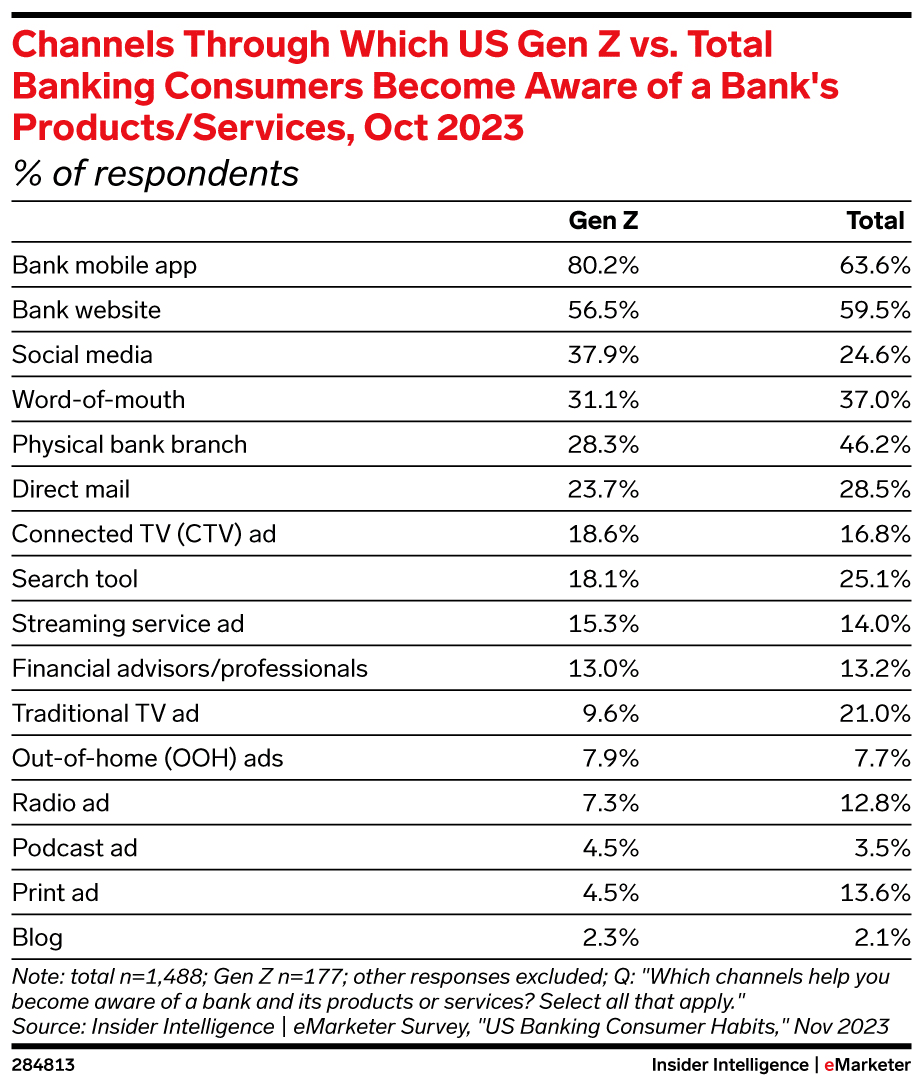

Banks’ mobile apps are crucial in raising awareness among younger consumers. Almost 80% of Gen Zers and millennials use mobile apps to learn about financial products.

Chase Bank offers a streamlined mobile app to help cater to the preferences of younger generations.

Partnering with marketing agencies specializing in reaching younger demographics further optimizes content for platforms like TikTok, Instagram, and Snapchat. While agencies might require a higher investment than AI solutions, their expertise offers significant value.

To better understand Gen Z and Millennials’ financial needs and preferences, advertisers can rely on KORTX intelligence.

💡 Key Takeaway

Financial institutions need to modernize communication to reach younger generations. AI personalization and partnering with relevant agencies can bridge the gap for Gen Z’s preference for quick, convenient, and supportive communication.

What is a top challenge you see in bank marketing and financial trends in 2024?

“Personal finance brands face many marketing challenges in 2024, particularly related to the process of organizing and activating First-Party data. With such a broad portfolio of products and services that consumers can leverage for their personal banking institution, it’s critical to have a sophisticated First-Party data strategy in place. Not only does this represent one of the most valuable digital marketing assets, it also opens opportunities for user insights, cross-selling, and customer retention.”

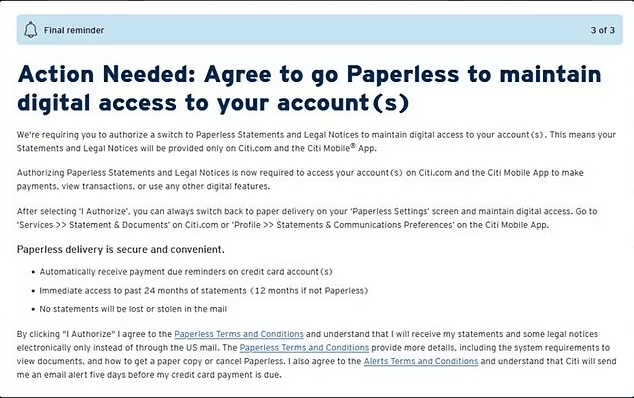

9. Boosting E-Statement Adoption to Cut Costs

E-statement adoption remains low in the banking industry, but emerging strategies promise to boost adoption rates and significantly reduce costs.

Switching to e-statements could save banks hundreds of millions annually in postage, paper, envelopes, and labor. However, many customers remain wary of switching, haven’t prioritized it, or still require paper statements for various reasons.

Citibank’s attempt to phase out paper statements by targeting digitally active customers with a threat of losing online access backfired, resulting in negative press.

Although customers could keep paper statements, they said the “punitive” move rubbed them the wrong way.

Consumers should have the option to go paperless based on their best interests. They should feel secure making the switch.

Targeted Approaches

Customer motivations and abilities vary widely, so a targeted mix-and-match messaging approach is essential:

- Seniors: Emphasize improved security features of e-statements.

- Gen Zers: Highlight cost savings and eco-conscious benefits.

- Communication Methods: FIs should use each demographic’s preferred communication methods to promote e-statements.

💡 Key Takeaway

Increasing e-statement adoption requires understanding customer motivations and offering tailored incentives. A mix-and-match approach, respecting customer choice, can boost adoption rates and achieve significant cost savings.

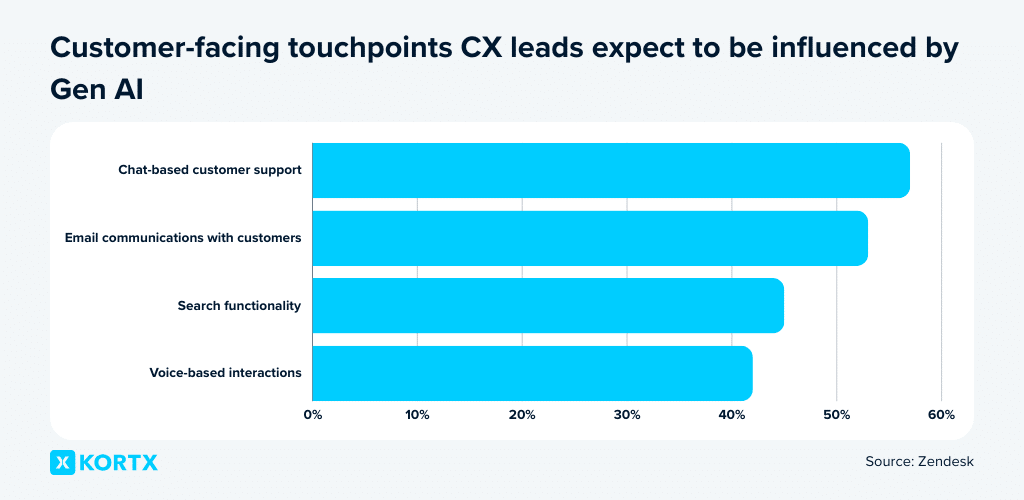

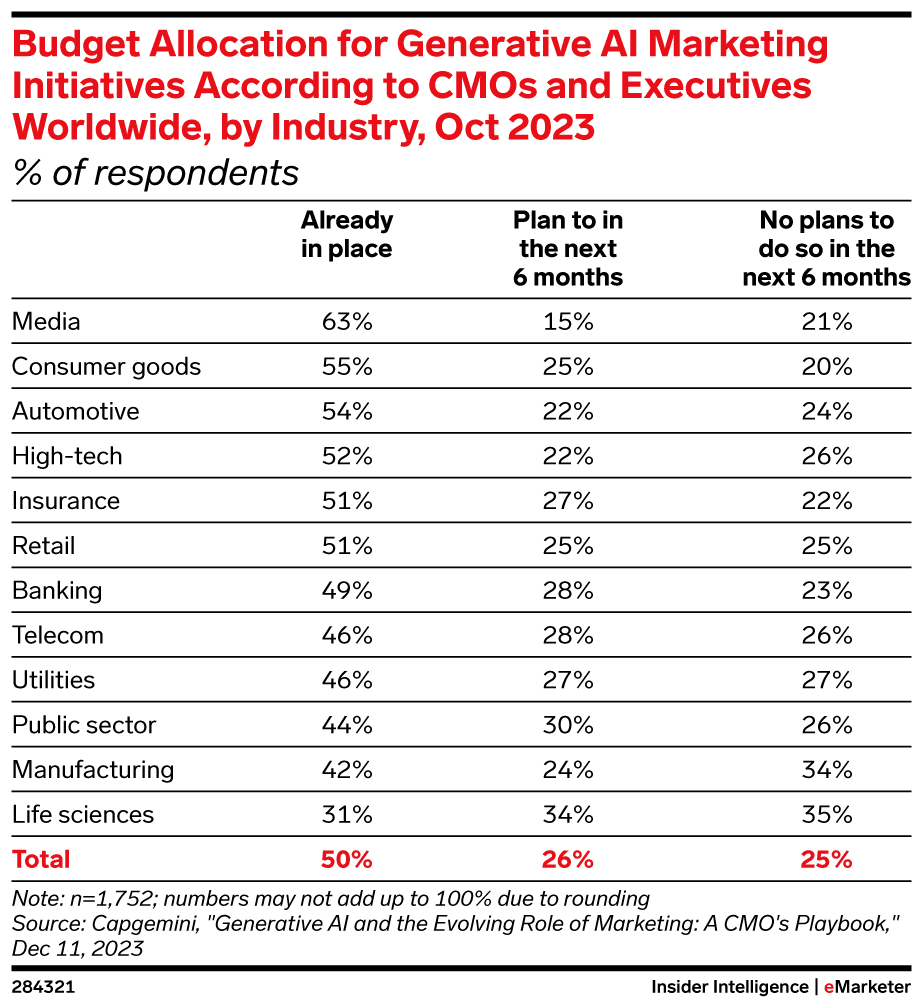

10. Consumers Prefer genAI-Created Content

60% of consumers favor generative AI (genAI) creators over traditional creators. Marketing professionals are even more optimistic about genAI than consumers:

- 82% believe genAI will lighten the workload for content creators.

- 86% think it will boost the quantity of content produced.

- 75% of marketing professionals believe consumers want more genAI in content creation.

GenAI, with human oversight, boosts marketing by enhancing creativity and efficiency. It analyzes customer data to deliver personalized content, like product suggestions and financial guidance.

How has Generative AI impacted banking & financial advertising trends in 2024?

“According to the latest Gartner CIO and Technology Survey (2024), 42% of banking CIOs are either deploying or planning to deploy GenerativeAI within the next year. This statistic highlights a significant trend towards integrating AI into banking operations.

As we navigate these advancements, it’s important to approach them with awareness and strategy. Understanding both the opportunities and risks will be pivotal in shaping the future of banking.”

JPMorgan and Capital One are winning the genAI race so far by conducting research and securing top AI talent. However, there is still time for smaller financial institutions (FIs) to get involved. Only 6% of small FIs have companywide AI implementation roadmaps, so those who start now could still outpace many competitors.

💡 Key Takeaway

By integrating genAI into their marketing strategies, banks can enhance content creation, improve customer engagement, and stay ahead of smaller FIs.

11. CEOs Undervaluing Marketing Teams

Bank marketing is undergoing significant changes, with CEOs needing better understanding and support to appreciate its value.

Bank of America and Wells Fargo have both announced plans to retire from their top marketing positions, echoing similar decisions by companies like Walmart and Etsy.

Bank of America merged its 1,400 marketing employees with its digital team, while Wells Fargo spread out its marketing team across multiple internal divisions. These moves indicate a trend of restructuring and distributing marketing responsibilities internally.

The Perception Problem

A Chief Marketing Officer’s (CMO) value isn’t as easily measured as that of a Chief Revenue Officer, leading to trust issues:

- Only 20% of CEOs trust the CMO to be “on their side.”

- Just 10% of CEOs feel marketing prioritizes their needs.

- Only half of CEOs believe their marketing team helps drive revenue.

Banks must integrate more technology while optimizing budgets. Marketing teams must align their work with the institution’s strategic goals and measure progress. This approach helps secure CEO buy-in and makes their efforts recognized and valued.

💡 Key Takeaway

To overcome the perception problem and gain CEO trust, bank marketing teams must demonstrate how marketing efforts contribute to the financial institution’s success. This will be crucial in solidifying the importance and value of marketing in the banking sector.

Banking’s Digital Makeover in 2024

To stay relevant, traditional banks must embrace key financial advertising trends. Implementing digital strategies that leverage AI personalization and mobile technology is crucial for connecting with younger generations. Marketing efforts that celebrate diversity and partnerships with innovative fintech companies will demonstrate to modern consumers that banks understand and cater to their needs, keeping these customers happy for years to come.

About the Author

Erik Stubenvoll is a Managing Director at KORTX with over 20 years of experience. When he is not learning about his client’s goals, he is on the sidelines with his wife at his daughter’s softball and soccer games or on the golf course.