About Axon: Combining access to over one billion user profiles with first-party data aggregation and real-time reporting, the Axon platform is the key to KORTX’s data-driven advantage.

A Look at the Automotive Buying Cycle

In this post, we’ll examine how Axon event-tracking and holistic data aggregation are used to execute campaigns aligned with the typical sales cycle of a large automotive advertiser.

For this client, our Axon tagging strategy is built around pixel placements aligning with customers’ normal car buying journey. Studies have shown this purchasing cycle usually takes more than 60 days, and these digital shoppers typically follow a set pattern of behavior. The following digital touchpoints are tagged across all local dealer sites and analyzed independently – removing the siloed programmatic approaches of individual dealers.

Purchase Cycle Events:

- Review OEM site

- Search local dealers

- Review models and deals

- Research trims and vehicle add-ons

- Research the specific VIN and that vehicles’ intricate variables

- Contact the dealership and complete online forms

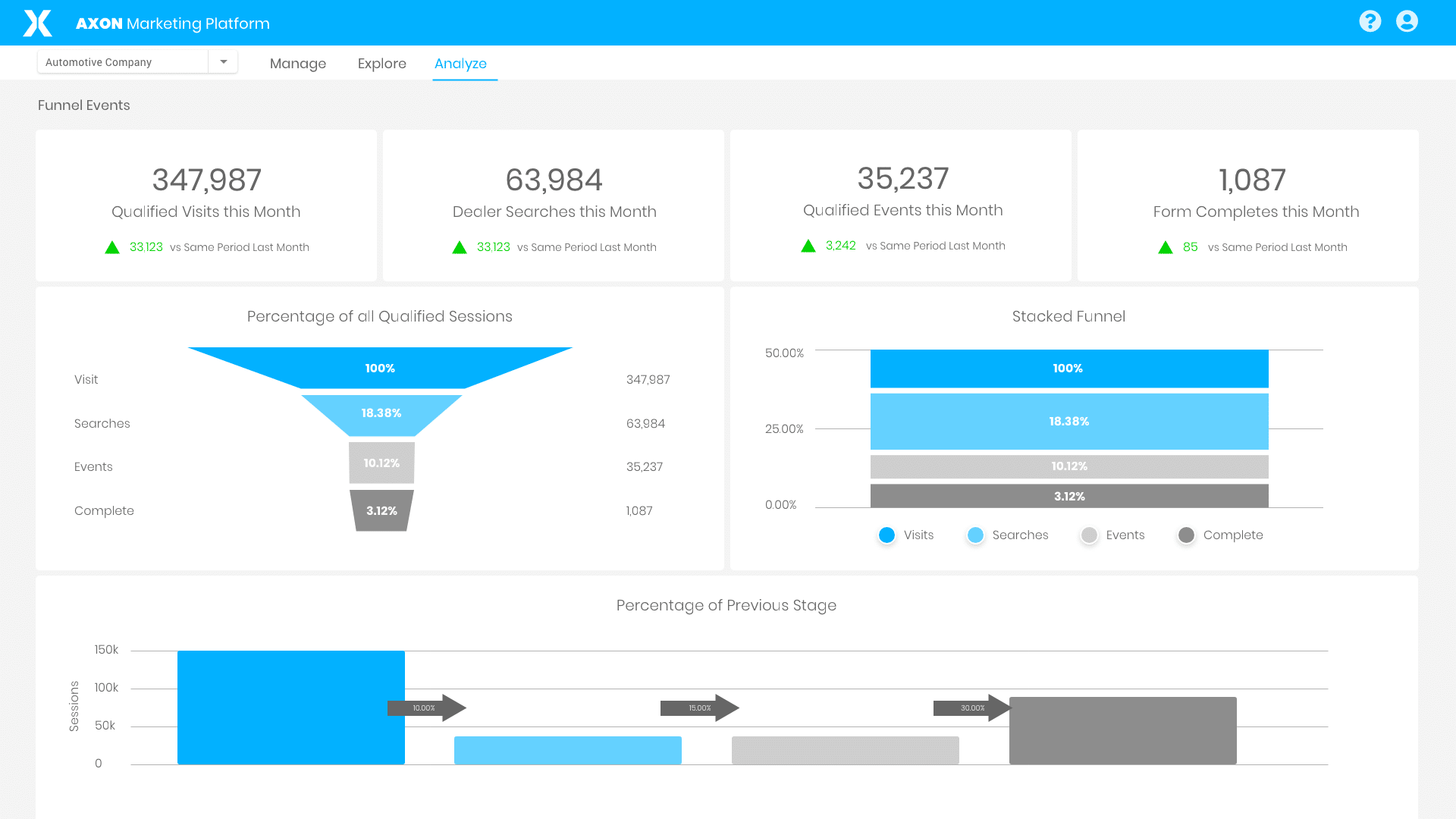

Funnel Development in Axon

With Axon, we can curate specific, granular segments of these customers based on their actions and target according to each user’s location in the funnel. As they move from visiting the home page, to reviewing vehicle specifications based on VIN, to completing a form, to contacting a dealer, we can adjust the strength of our bidding or frequency and recency of media delivery accordingly.

Additionally, these segments of site visitors (homepage visitors; model page visitors; new and pre-owned inventory visitors; specials; finance; service and parts; touchpoints on the vehicle specifications page; or ‘contact us’ forms) can be modeled for prospecting, helping fill every step of the marketing funnel in addition to nurturing existing leads.

Custom Insight for Efficient Audiences

Client prospecting using algorithms powered by digital behavior analysis can be best described with the following analogy:

If an advertiser purchases a television spot with an estimated reach of 100,000 people, the number of viewers out of 100,000 that are actually in-market for a car is usually unknown (let’s estimate 1,000/100,000 are in-market). Knowing 99% of your target audience is not in-market may be acceptable for a branding campaign, but it makes for an inefficient option for anything lower-funnel.

Targeting the same area digitally with the support of Axon, we use audience modeling off of the customer attributes of our site engagers to reduce that 100,000 number to something far closer to 1,000. Through segment analysis – breaking down the attributes and behaviors of our current shoppers – we determine who is most qualified to receive in-market advertisement. It’s as if the advertiser knows beforehand exactly which households have consumers who have reviewed car deals in the local newspaper, called their local dealership, or have a vehicle breaking down at 240k miles, and selectively targeted only those televisions with their commercial.

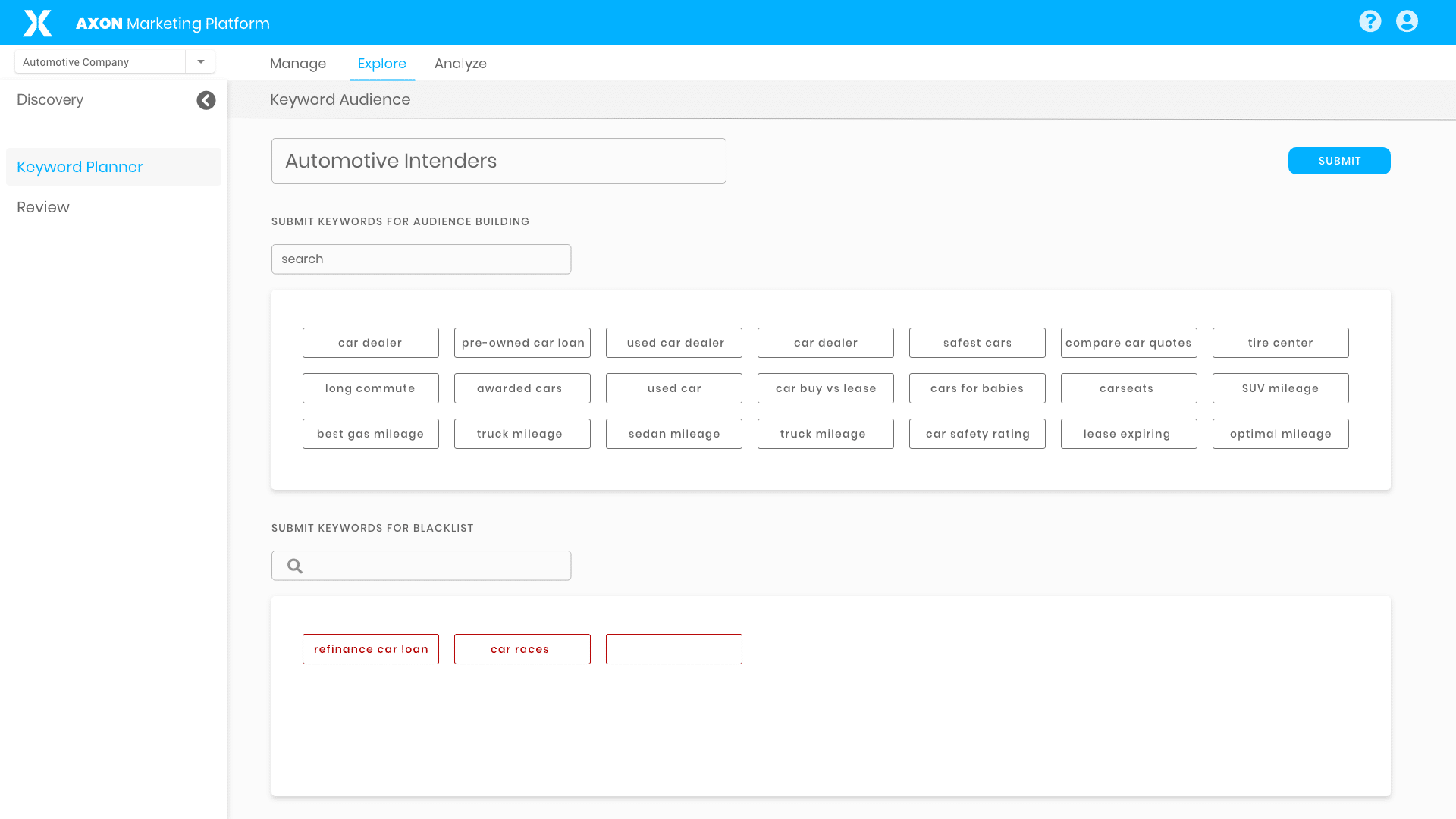

Relevant Messaging Across the Funnel

With holistic data aggregation in Axon, we go beyond knowing whether a consumer is in market and actually begin to understand why. Perhaps they are expecting a new child and need a larger car (searches “best car for 3 car seats”); got a new job; were just relocated for work (searches “best car for long commutes”); or received a promotion. All of these attributes and characteristics can be stored, analyzed, synthesized and employed to provide first class prospecting. With Axon, advertisers begin to spot commonalities and patterns very early in the purchasing process.

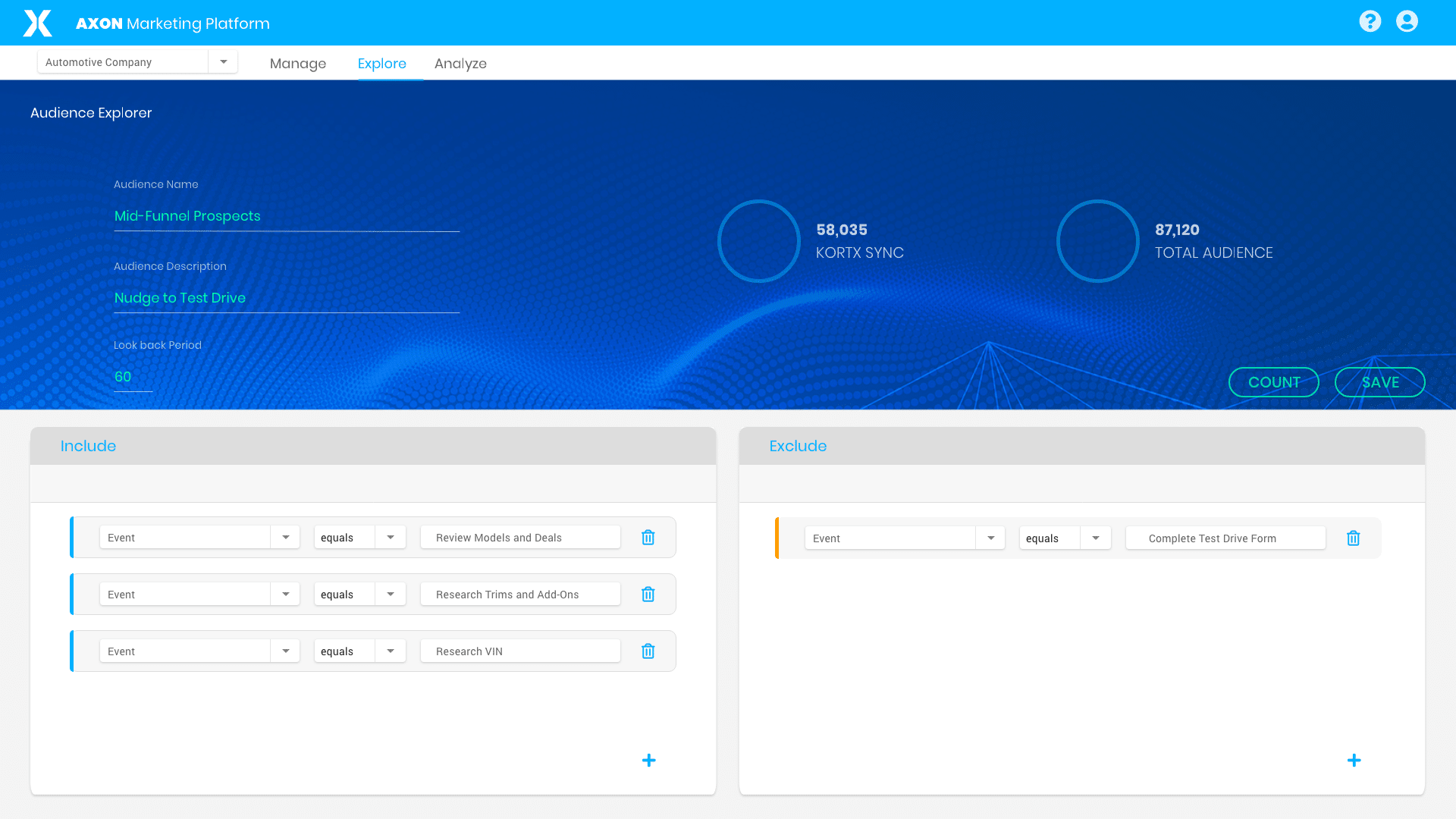

A multi-tier strategy involving prospecting high to low funnel car shoppers can be developed through the predictive capabilities of audience modeling algorithms – leveraging the attributes of site visitors to drive our prospecting efforts. Creating look-alike audiences from those site visitors who have not gone further than the home page is an opportunity to engage in a high funnel branding campaign with potential customers who are many weeks away from deciding on the car they want. This modeled audience may show a propensity to watch a car video on YouTube, utilize generic search terms (“how to lease a car” or “photos of a 2019 F150”), visit the OEM’s Facebook page, or read an article about cars.

For mid-funnel shoppers, modeled segments of customers who engaged with touch points deeper than the homepage – perusing their local dealers’ inventory and specials’ pages – drives prospects 15-45 days from purchase. These auto intenders compare different models from different brands; visit consumer review sites; and build and price vehicles on the OEM site.

Lastly, modeling low funnel engagers – those who took action on a VIN page to review granular vehicle specifications; completed a ‘request a quote’; scheduled a test drive; or submitted ‘contact us form’ – takes on a conquesting-esque tactic. Competitive brands can jump in at the end of the purchasing cycle to provide a great deal to a customer who was showing interest in a comparable vehicle model and/or trim package.

With Axon, the data we utilize powers client prospecting and retention. As the quality and quantity of site visitors increase, your pool of site engagers are continuously providing all strategies with the most up to date characteristics and attributes of your current shoppers.