Experiences refined for people

Experiences refined for people

Once a bastion of binge-watching “just one more episode,” Netflix opened its doors to advertisers in November 2022, a seismic shift that has paid off handsomely. What started as a gamble became a major new revenue stream.

By Q3 2024, Netflix’s revenue surged to $9.82 billion, with ads helping pad the bottom line.

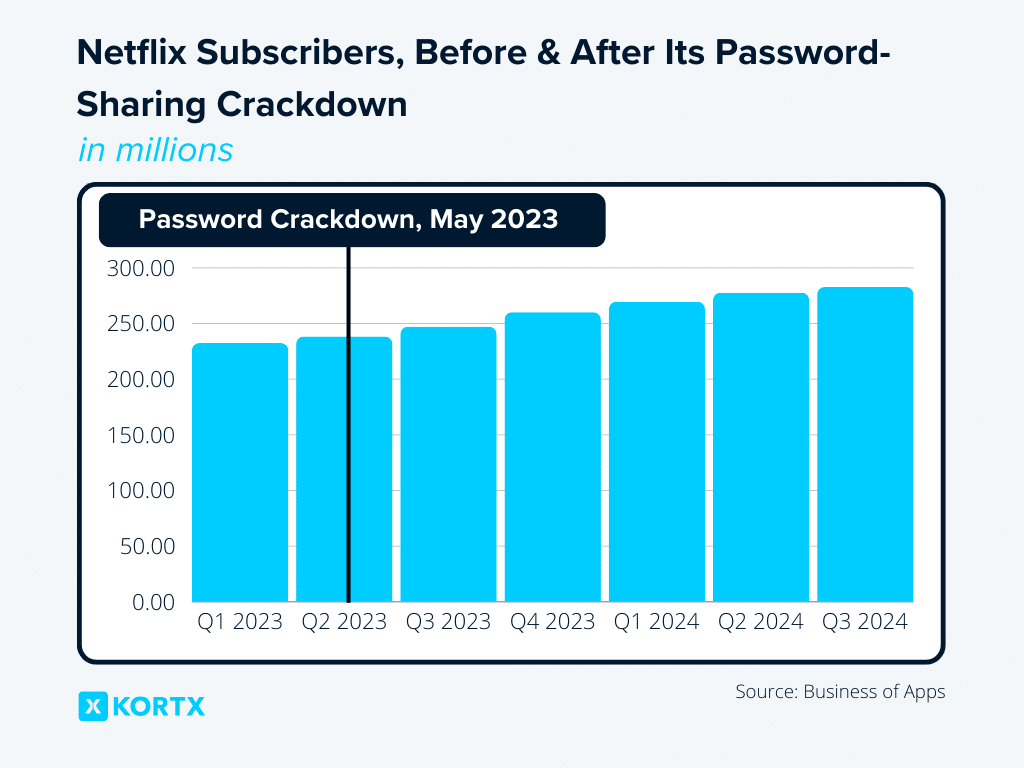

So, how’d they do it? First, they cracked down on password-sharing, turning our freeloading friends and cousins into paying customers. Then, the streaming service went all-in on Connected TV (CTV) ads, snapping up ad dollars while others, like Discovery (HBO) Max, tiptoed in. Netflix took off at a sprint, capturing viewer attention as audiences ditched cable for streaming.

The question now is this: how wide has that ad net been cast, and do the numbers show it’s catching anything worth keeping?

Netflix’s ad setup is pretty standard for streaming services: MediaRadar reports that 56% of its ads run between 15 and 30 seconds, with a solid 86% landing mid-roll—hitting you right when you’re deep into the show.

As Q4 2024 rolled in, Netflix is betting on big events and fresh content to keep viewers locked in. From the Tyson-Paul boxing match and NFL Christmas games to the next season of Squid Game, they’re ramping up the variety to capture every possible viewer minute.

Is Netflix’s ad tier succeeding?

“I think Netflix is doing a great job here [with its ad tier]. They have a large pool of fixed costs (producing content) and are seeking to maximize total revenue, which they do by carefully calibrating the prices for the ad tier and the ad-free tier, as well as deciding on the ad load. Maximizing total revenue is the right goal here, but it’s not the same as preserving ARPU, and it’s not about scaling the ad business alone, despite what some critics may say.”

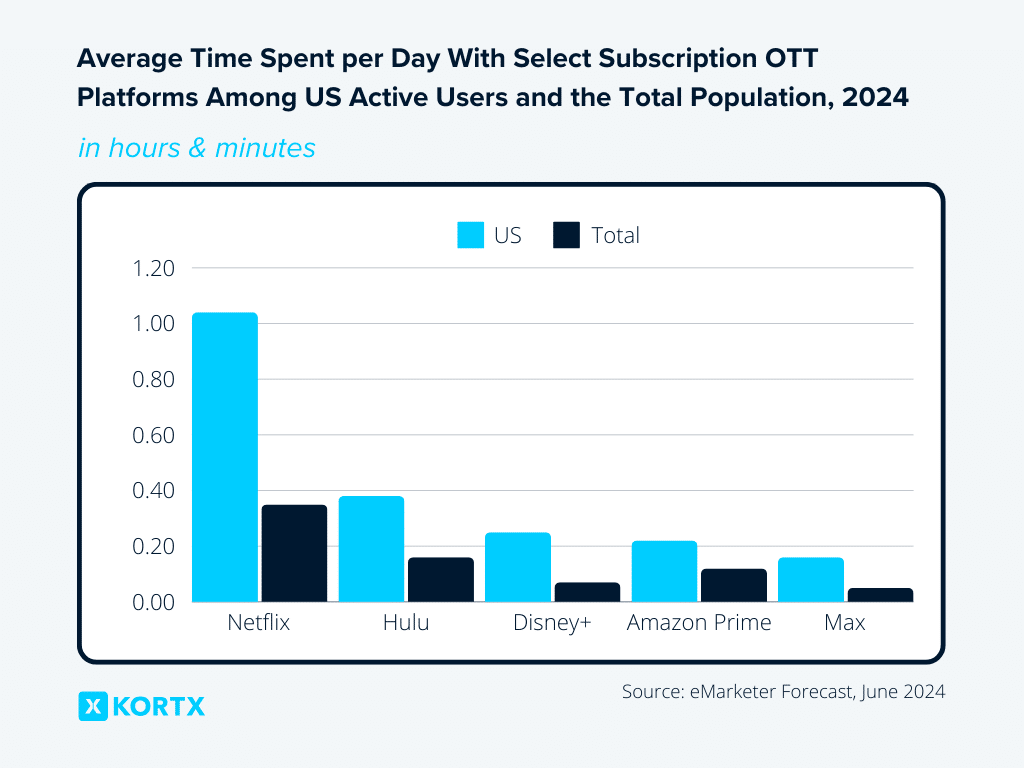

Now leading in the US for time spent, Netflix keeps viewers hooked for an average of 1 hour and 4 minutes a day—outperforming even TikTok and YouTube (51 minutes each). For advertisers, this means a loyal, highly engaged audience.

Ad-Tier Subscriber Numbers: 2025

Since its launch in late 2022, Netflix’s ad-supported plan has attracted consistent interest. By 2025, roughly 10% of US Netflix subscribers are expected to opt for this budget-friendly tier.

Meanwhile, streaming costs—which once offered a cheaper alternative to cable—are now nearly just as high. Platforms keep multiplying, prices keep rising, and Netflix’s ad-free Standard plan now sits at $15.49 a month—almost double the $7.99 it cost in 2011. Yet, subscribers keep signing up. In Q3 alone, Netflix added 5 million new accounts.

Password-Sharing Crackdown: Revenue Boost

Netflix’s password-sharing crackdown was supposed to fail, or so the experts said. However, it worked like a charm, with many opting for the ad-supported plan.

While the initial surge in new users slowed, this strategy continues to generate a steady stream of sign-ups.

Gen Z Embraces Ads for Savings

Gen Z, known for budget-conscious spending, represents 68% of Netflix’s viewership, second only to YouTube. With 60% of households under 35 favoring ad-supported streaming to save money, Netflix’s ad-supported plan is gaining traction among younger viewers.

Ad-Tier Engagement: Almost on Par with Ad-Free Users

Ad-supported users spend around 54 minutes daily on Netflix, nearly matching the 64 minutes logged by ad-free subscribers. Peak ad viewing occurs between 5–10 pm, capturing 70% of ad impressions, ensuring advertisers reach engaged viewers at optimal times.

Just like any ad buy or marketing strategy, your team or brand should focus on whether or not Netflix ads work for your goals. The following advantages and disadvantages should be weighed before making a buy.

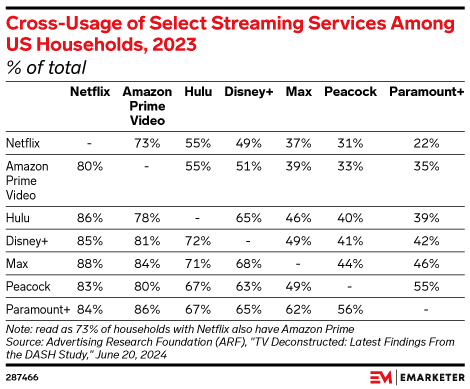

💡 Pro-Tip: Limit ad frequency for Netflix audiences on other streaming platforms to prevent audience. Remember, most households subscribe to 4+ services.

Start by identifying your target audience and deciding if Netflix is the right platform to reach them. Not all audiences are on Netflix; some prefer free, ad-supported platforms like Tubi or other FAST (Free Ad-Supported Streaming TV) services.

Knowing where your audience spends their screen time helps you place your campaign where it counts.

For more on how to advertise on free ad-supported TV, read our FAST advertising guide.

Netflix offers several ad options, each with unique benefits based on placement and viewer engagement. Here’s a quick overview of ad specs to help you align your creative effectively:

New ad formats, including binge ads, live sports ads (like NFL and WWE), and enhanced placements like pause ads, are also emerging.

Netflix offers:

To launch your ad on Netflix, you can start by filling out Netflix’s request for advertising form directly or working with a professional agency. For broader strategies, consider integrating Netflix as a proven publisher.

Boost your multi-platform strategy by pairing Netflix with powerhouses like YouTube, Hulu, and Amazon. This approach amplifies reach, engaging diverse audiences across trusted, high-traffic platforms.

Use Netflix Ads Manager or your agency’s analytics tools to track campaign results. Experimenting with different versions of your ad—changing the wording, visuals, or calls to action—helps you see what resonates best with your audience.

What are some effective measurement strategies for Netflix ads, given the challenges around cookie-less environments?

“One of the main challenges in measuring Netflix and really all streaming service ads is the lack of cookies—no traditional identifier to work with.

So, we can take two key approaches. First, we can use IP-based tracking with platforms like Xandr. By tapping into IP addresses, we can connect multiple devices under the same IP and track who’s actually converting on an ad. Basically, we link device IDs to a shared identifier to follow conversions more accurately. Xandr’s device graph pulls in IP and device IDs, plus Microsoft’s ecosystem gives us precise tracking without needing traditional cookies.”

Regardless of how you analyze the data, Netflix continues to dominate among streaming platforms. It boasts such a vast audience that the average time spent on the platform will reach 35 minutes per day for the adult population in 2024.

No, Netflix Premium does not include ads. Ads are only shown on the Netflix Basic with Ads plan, allowing Premium and other ad-free subscribers to enjoy content without interruptions.

Netflix Ad Manager is the platform’s dedicated interface for advertisers. Powered by Microsoft, it allows advertisers to set up campaigns, select target audiences, and upload creative assets.

On the ad-supported plan, users see a few short ads per hour, placed at natural plot breaks. Ads play before and during select shows and movies, while new releases typically show ads only at the start. The progress bar marks ad breaks, and a countdown shows the number of ads left. Most ads run 15 to 30 seconds.

Ads are selected based on several factors, including a user’s interactions with Netflix (such as content genre), general location (like city and state), and information shared with Netflix.

Unless users opt-out, ads may also be tailored based on interactions with third-party apps and websites (behavioral advertising). If behavioral ads are opted out, users will still see ads, but they won’t be targeted using behavioral data.

Netflix provides expanded targeting capabilities, including options based on demographics, viewing habits, and content context (e.g., Top 10 content placement or genre targeting). Netflix also offers brand safety controls, allowing advertisers to avoid placements near specific content types, aligning with brand safety preferences.

No, Netflix ads cannot be skipped or fast-forwarded while watching TV shows and movies. However, viewers can pause playback during an ad if needed.

Yes, Netflix has started including ads in live sports content. On Christmas, Netflix will show NFL games and begin airing WWE programming in 2025. These live events may contain commercial breaks, even on ad-free plans, as part of the live broadcast format. Fast-forward and skip options are unavailable during these live events when ads are playing.

At launch, CPMs ranged from $65 to $80, but those rates have started to drop. According to ad buyers, recent deals show that some advertisers are paying around $39 to $45 CPM, down from the previous $45 to $55 range.

Netflix’s analytics tools let advertisers track impressions, click-through rates, and viewer engagement. The recent integration of Nielsen ONE Ads, launched in October 2023, gives US advertisers even sharper insights.

Nielsen’s tool taps into Netflix’s First-Party data and a representative panel to measure all digital impressions.

If Netflix doesn’t fully align with your advertising goals or audience, here are several alternative platforms to consider:

Each platform offers unique audience demographics, targeting features, and ad formats, providing flexibility for brands looking to diversify their streaming ad strategy.

Are there alternatives to reaching Netflix users?

“Marketers that can access a specific combination of data partners and ad inventory sources in their preferred DSP will be ahead of the curve when owned and operated Netflix ads quickly sell out and pricing soars. Don’t sit on the sidelines—a strategic data and inventory approach lets you reach Netflix users at scale outside its walled garden.”

Brands and agencies priced out of Netflix’s ad slots can still reach its viewers through smart audience targeting and cross-screen programmatic buys.

With ACR (automatic content recognition) data, marketers can target users by genre or specific program based on what they’ve watched on Netflix. This approach doesn’t rely on Netflix’s platform and cuts down on both data and inventory costs while allowing for more audience targeting options than Netflix’s own offerings.

The key advantage? Reaching Netflix viewers across multiple channels—Display, Video, OTT/CTV, Native, and Audio—wherever they are, on any device.

Netflix’s ad game is growing up fast, and 2025 promises new tricks: sharper targeting, flashier formats, and ads in live sports—for those moments when you’re glued to the screen, not the fridge. Brands, of course, are flocking to get their slice of the action.

And the rest of the streaming industry? Watching Netflix’s every move, because it might just be writing the rules.

From us to your inbox weekly.