Experiences refined for people

Experiences refined for people

Online banking, led by giants like Ally, continues to reshape finance, cutting costs and boosting digital efficiency. Customers lean heavily on online research and prefer online banking experiences. Building a solid online presence and savvy digital advertising campaigns are key to winning and keeping digital banking customers.

Discover 8 bank and financial marketing strategies to learn how to adapt to these shifting preferences.

Bank marketing refers to the strategies and tactics banks and financial institutions use to promote their products and services, engage customers, and drive growth.

The overarching goal is to increase the bank’s profitability through:

New technologies and emerging trends underscore the importance of a strong digital bank marketing strategy in 2024.

What is the goal of bank marketing?

“The overarching goal is to increase the bank’s profitability through a multi-faceted approach. This includes boosting brand awareness, acquiring new customers, retaining existing ones, cross- and upselling services, and nurturing trust and reputation.”

Bank and financial marketing has shifted considerably in the last decade. This has been driven by technological advances, changes in consumer behavior, and evolving regulatory practices.

Here’s why you need a strong digital banking strategy in 2024:

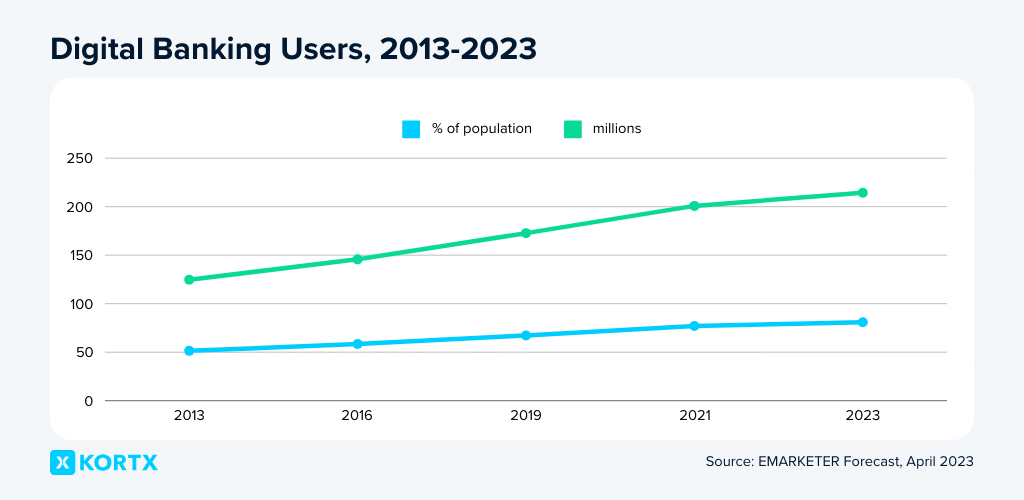

In an era where customer loyalty is hard-won, a compelling digital presence serves as a significant differentiator. In 2013, only 51.4% of bank users had an online banking account. In 2023, 80.8% accessed their banking online–a growth of 57.2%!

97% of Gen Zers will be digital banking users by 2027—the highest proportion of any generation.

The banking sector is rapidly adopting emerging technologies like GenAI (generative artificial intelligence), digital wallets, and advanced data analytics.

These innovations reshape customer engagement by personalizing services and enhancing security. With these integrations, banks remain ahead in the competitive field, aligning with changing customer demands.

In 2023, the U.S. banking sector faced changing regulations due to technological advancements, climate change, and financial crises, resulting in stricter oversight and new risk management frameworks.

In 2024, banks need a flexible digital strategy to comply with these regulatory changes, manage risk, and meet growing consumer and regulatory expectations.

Some Changes in US Financial Institution Regulations Over the Last Decade

Fintech companies are outpacing traditional financial institutions (FIs) in brand awareness thanks to innovative marketing strategies that resonate with modern consumers, such as creative campaigns, effective use of digital platforms, and engaging customer incentives.

In the old banking customer funnel, awareness was generated through physical branches, billboards, and traditional advertising.

Consideration and acquisition involved in-person branch visits for information and completing lengthy paperwork. While post-acquisition, banks used personal interactions, direct mail, and in-branch visits to maintain relationships and offer new services.

Now, the stages look more like this:

For marketers, this means adapting strategies to prioritize digital channels throughout the entire banking customer journey.

🔎 Case Study Success: Trustmark Bank Full Funnel Marketing

Discover how KORTX Implemented a full-funnel strategy to drive conversions across multiple lines of business.

Banking digital ad spending growth slowed considerably from 2022-23, and the financial services industry has lagged overall. Bank marketers must do more with less.

Explore the key strategies for banks and other financial institutions to thrive in the coming year.

The idea of a ‘primary’ bank is becoming outdated. Consumers increasingly prioritize convenience and better rates over loyalty to a single institution, leading to a more fluid banking landscape where multiple accounts across different banks.

Over a third of Americans hold more than one checking account, and among millennials, that percentage is around 50%.

What are Neobanks, Fintechs, or Big Tech firms?

Banks must adapt to this new reality by focusing on what makes their services uniquely valuable to consumers, like:

Traditional Financial Institutions Lag in Their Branding Campaigns

69% of consumers recognize fintech brands, but just 59% are aware of newer offerings from traditional FIs.

Traditional banks must prioritize competitive rates, highlight security features, and streamline account opening processes to retain and attract customers against neobanks and fintechs.

The rise of Big Tech and digital banking makes opening accounts and transferring money easier for customers. However, this leads to silent attrition, as many customers don’t choose to close their old accounts when they switch to new financial relationships.

To tackle the hidden cost of attrition, banks should leverage First-Party data for detailed analysis of customer behaviors and apply predictive analytics to identify early signs of churn.

By using dynamic audience segmentation and lifetime value tools, banks can focus their marketing on the segments most likely to be attracted. This optimizes the use of resources.

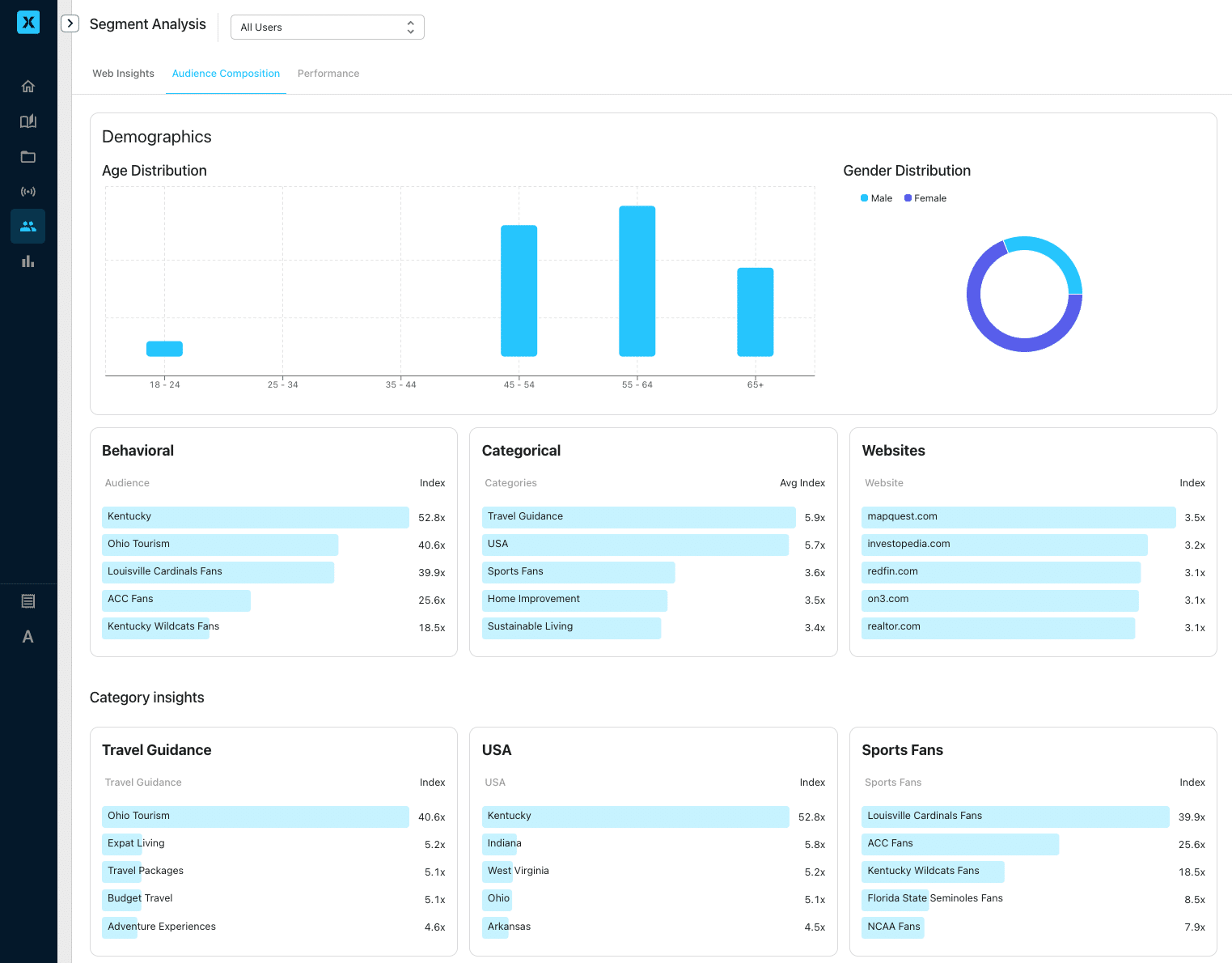

Audience insight tools, such as Axon Audience Manager’s Audience Composition report within our Kampus dashboard, can identify patterns and behaviors that signal potential attrition risks. These risks include increased transaction frequency, changes in account activity, or dwindling engagement levels. Banks can then target these at-risk customer segments with tailored engagement and retention strategies before they start looking for alternatives.

An example of an Audience Composition report within our Kampus dashboard, breaking down very granular audience insights.

Banks can use audience data to improve the customer experience through personalized and relevant offerings. While US banks traditionally lure customers with large sign-up bonuses, the ease of opening new accounts now makes consumers less receptive to incentives.

Instead, banks should focus on target segments’ financial goals, like Bank of America, which emphasizes wellness tools and financial advice in its #BetterMoneyHabits ad series.

By understanding customer behaviors and proactively offering personalized experiences, banks can mitigate the risk of losing customers to competitors. This can protect their SOW (share of wallet) and establish themselves as customer-centric institutions.

How can businesses effectively address customer churn before it occurs?

“Customer churn is a lagging indicator, meaning the loss has already happened, and it’s just a measurement of the damage inflicted. Trying to recover these customers is often a money-losing strategy.

To reduce churn, you need to get ahead of the loss by identifying leading indicators that help identify when a customer is about to stop using your organization or divide their relationship—before they actually do. The goal is to increase the value proposition of using your organization’s services instead of marketplace alternatives.”

Acquiring new customers can be expensive. Retaining existing customers is significantly more cost-effective than constantly pursuing new ones.

With the phase-out of Third-Party cookies, First-Party data allows banks to understand customers’ needs based on their past interactions and transaction history without relying on expensive publisher data.

Cross-selling is key, especially for credit unions and regional banks. The strategy leverages existing customer ties from auto loans or other accounts, to cross-sell services like mortgages and checking accounts. Upselling current account holders aims to engage customers across the bank’s service spectrum.

How can banks and credit unions adapt to the changing landscape of financial services to improve customer relationships and retention?

Taking a “needs-based” approach to cross-selling increases conversions and reduces the risk of bothering customers with unwanted offers. Instead of focusing only on the bottom line, banks and credit unions should view cross-selling as cultivating a relationship based on helping customers and members succeed financially.

Also, the proliferation of online-only, app-based services is necessary as they are more focused on helping users on their financial journey–especially younger users who often begin their banking experience online.”

PwC advises adopting a data-driven strategy where banks create detailed customer profiles from diverse data sets to target specific segments with customized campaigns.

Utilizing insights from payment behaviors, borrowing history, and preferred channels enables banks to deliver personalized, needs-based solutions that enhance conversion rates and reduce the chance of customer dissatisfaction with irrelevant offers.

Using First-Party data for personalized cross-selling effectively reduces customer acquisition costs and significantly boosts returns by retaining and deepening relationships with existing customers.

Retargeting reminds customers of the products they’ve shown interest in. Similar to cross-selling, banks can target existing customers using First-Party data.

Successful retargeting involves:

Banks can convert interest into action by implementing these strategies, enhancing customer engagement and conversion.

Advanced retargeting strategies empower banks and credit unions to re-engage potential customers and convert window shoppers into active prospects.

During crisis periods, marketers focus more on lower-funnel advertising strategies. An example is the increasing portion of digital advertising budgets allocated to paid search since 2021.

The quest for quick conversions often overshadows brand marketing’s value. Ally Bank’s study with TransUnion and Dynata proves it. Ally focused on integrating substantial investments in brand creative alongside performance-driven tactics such as paid search and social media to drive account sign-ups.

Over nine months, they evaluated the brand campaign’s impact on consumer favorability and perception, specifically assessing whether consumers saw Ally’s products as easy to use and worth considering for future financial needs. Exposure to Ally’s brand made consumers six times more likely to open accounts.

By focusing on brand loyalists, Ally slashed its Customer Acquisition Cost (CAC) by 87%.

Increase in Favorability Among Non-Customers

Favorability increased by 7% among individuals who had never banked with Ally.

The more people like a brand, the more likely they are to take action. Integrating brand marketing with performance marketing strategies significantly enhances customer acquisition and favorability and, in turn, drastically reduces customer acquisition costs.

Fintechs are eclipsing traditional financial institutions (FIs) brand awareness due to strategic marketing differences.

80% of consumers are aware of fintech services, doubling since 2015, with Robinhood, Chime, and SoFi outpacing giants like JPMorgan and Goldman Sachs. Robinhood retains about two-thirds of customers who try its services, compared to traditional FIs, which typically achieve at least 75%.

Traditional FIs can learn from fintechs like Robinhood, SoFi, and Chime to refresh their brand marketing strategies:

Robinhood captivated users with a hyped-up waiting list and referral program, reducing reliance on traditional ads for more cost-effective and word-of-mouth promotion.

Besides the traditional marketing mix of growing social media presence, email marketing, print, and outdoor advertising like DOOH, SoFi amplified its brand through sports advertising, securing stadium naming rights and forming partnerships with the NBA and NBA All-Star Jayson Tatum.

As the Official Bank of the @NBA, we brought the heat to All-Star Weekend! 🔥🏀

Looking for an assist to reach your ambitions? Switch to #TeamSoFi and get ready to hit those money goals. 💸 pic.twitter.com/gZ8v3MG0UQ

— SoFi (@SoFi) February 18, 2024

Chime focused on a strong non-branded keyword strategy. Chime blends SEO with dynamic content, including a curated blog, engaging social media, and an affiliate program, while innovative campaigns like “Happy Chime” and “Chime Feels” underscore its financial empowerment mission.

Traditional financial institutions can enhance their brand visibility and customer retention by adopting fintech marketing strategies, such as engaging referral programs, strategic partnerships, and holistic content marketing.

The shift to online banking focuses on cost reduction and smarter customer engagement. The cost-per-deposit ratio (CPDR) gauges new customer value by their deposits, emphasizing the importance of attracting not just more but the right kind of customers, given the wide variation in customer value.

Example: When two customers open bank accounts on the same day, but one deposits significantly more than the other, traditional metrics might view these acquisitions equally. However, using the cost-per-deposit ratio (CPDR), banks can identify and prioritize the higher-deposit customer, recognizing their greater immediate value.

Advanced analytics tools, including Kampus, provide deep insights into customer behavior and value by analyzing everything from account openings and deposits to investment activities and loan applications. Banks can refine their marketing strategies dynamically, targeting high-value customer segments with tailored outreach.

The data from metrics like CPDR enhances customer acquisition and can guide product development, service improvements, and strategic planning, helping banks align their offerings with the preferences of their most profitable customers.

Using advanced metrics like the cost-per-deposit ratio (CPDR) allows banks to effectively target high-value customer segments, driving smarter customer engagement and aligning offerings with profitable preferences.

Another effective strategy is advanced audience targeting with connected TV (CTV) advertising. As digital video consumption surpasses traditional TV, the audience on streaming platforms grows, offering marketers a large and engaged viewer base. Many bank advertisers lag behind consumers in adopting Connected TV (CTV), partly because it was less ad-supported until recently.

Streaming giants like Netflix, Hulu, Max, Disney+, and more introduced ad-supported tiers in the last few years. FAST (free ad-supported streaming TV) has also taken off, with 1-in-5 consumers trading their paid subscriptions for a free one.

Instead of broad targeting, banks can use First-Party data to identify specific customer segments, like those who have recently searched for home loans or savings account options. Then, they can use CTV platforms to deliver tailored ads to these segments.

DCO (Dynamic Creative Optimization) can automatically adjust and serve different versions of your ad creative based on the viewer segment.

Example: Viewers exploring financial planning articles might be shown ads for retirement accounts or investment services, making the advertising feel more personalized and useful.

By using advanced audience targeting with connected TV (CTV) advertising, banks can more effectively reach specific customer segments, capitalizing on the growing engagement of viewers on ad-supported streaming platforms.

What’s one of the biggest benefits of CTV advertising for banks?

“CTV viewers anticipate a fair value exchange for the free content they enjoy. They understand that ads accompany their viewing experience in exchange for a more affordable plan. This expectation fosters a receptive attitude towards advertising, with features like countdown timers and ad duration notifications enhancing viewer engagement.”

Bank marketing will continue to evolve significantly in 2024 and beyond. Embracing new technologies and understanding changing consumer behaviors remains essential. Banks now focus on engaging the younger generation, who prefer a digital banking experience.

We use data-driven methods and advanced technology to improve customer experience, boost brand visibility, and increase sales–all while maximizing your budget.

Erik Stubenvoll is a Managing Director at KORTX with over 20 years of experience. When he is not learning about his client’s goals, he is on the sidelines with his wife at his daughter’s softball and soccer games or on the golf course.

From us to your inbox weekly.