Experiences refined for people

Experiences refined for people

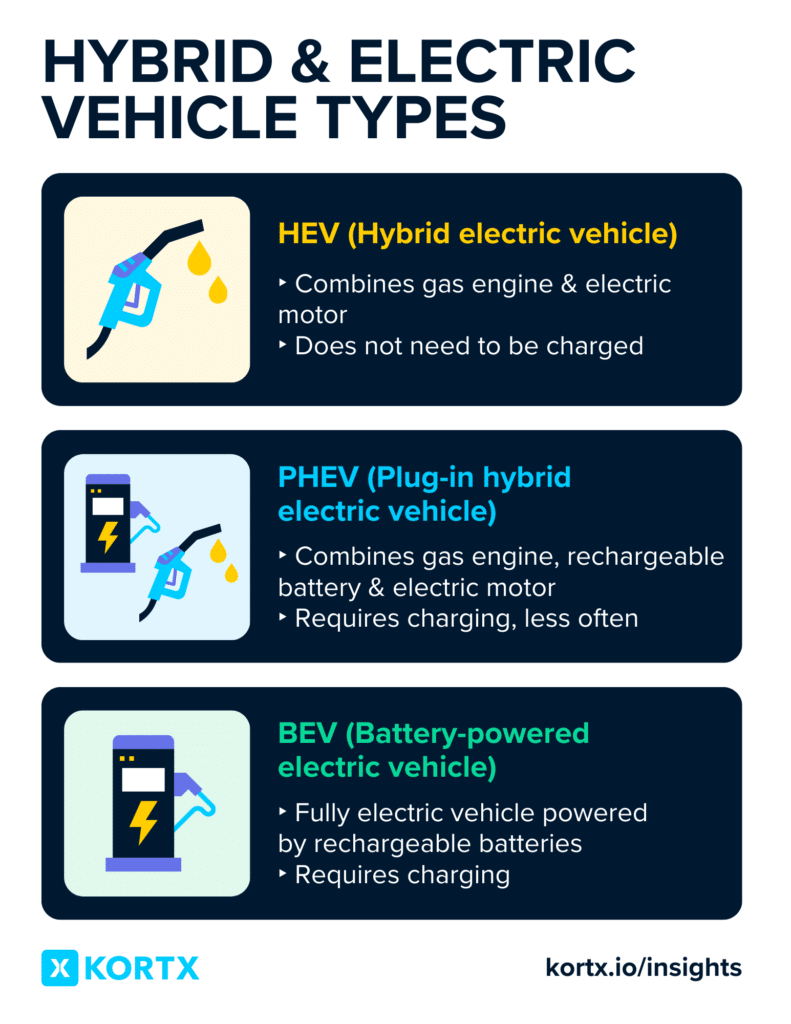

While EVs wrestle with charging woes and gas cars sputter, hybrids nail the sweet spot—efficient, practical, and eco-friendly without complicating life.

With sales soaring and EVs tapping the brakes, marketers have a prime opportunity to rev up hybrid demand and shape the future of sustainable transportation.

A Surge in US Sales

The Rise of Plug-In Hybrids (PHEVs)

A Global Boom

In 2022, 40% of prospective hybrid car buyers in the US were from high-income households. However, most hybrid owners fall within the middle-income bracket, earning between $50,000 and $100,000 annually.

Buyers fall into three primary demographics:

The hybrid boom isn’t just about clever engineering—it’s also fueled by strategic marketing, shifting consumer behaviors, and brands’ under-the-radar advantages.

The Inflation Reduction Act of 2022 extended a $7,500 federal tax credit for new plug-in hybrid electric vehicles (PHEVs) and a $4,000 credit for pre-owned clean vehicles. Vehicles must be assembled in North America and meet specific battery sourcing rules to qualify. Credits apply to purchases made between 2023 and 2032, encouraging cleaner transportation and domestic production.

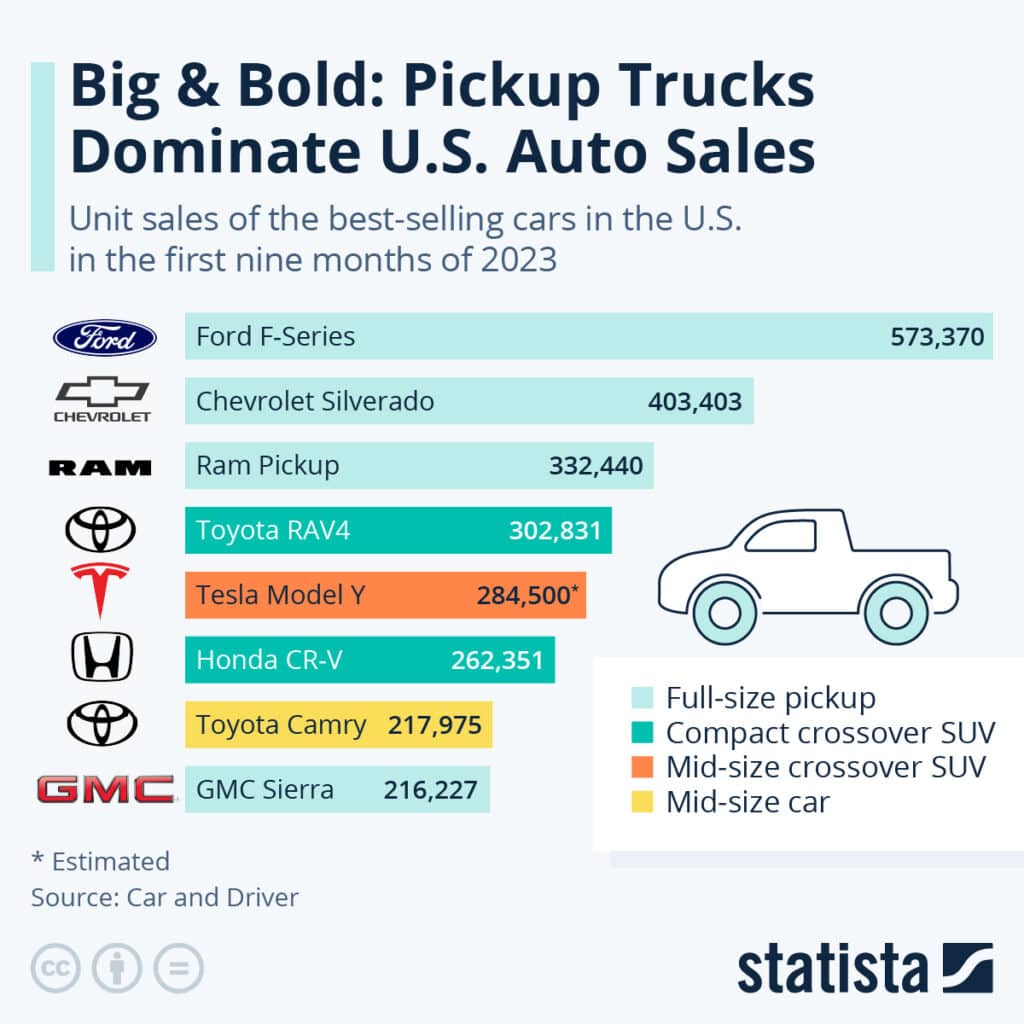

Pickup trucks attract diverse buyers, including urbanites, outdoor enthusiasts, and eco-conscious consumers. Nearly half of campers (45%) and 47% of personal haulers prefer pickups.

Ford plans to introduce the hybrid Maverick in 2025, offering towing power with improved fuel efficiency. Toyota followed with the Tundra Hybrid to compete globally.

High inflation and rising interest rates have strained the used car market, but hybrids remain popular.

By 2024, used hybrid prices stayed steady despite a 5.1% drop from Q2 2023 to Q2 2024, reflecting balanced supply and demand. Top models include the reliable Toyota RAV4 Hybrid and Lexus ES300h.

📅 A Short Timeline of Hybrid Vehicles |

|

| 1899: The Lohner-Porsche Elektromobil debuts at the Paris Exposition, featuring an internal combustion engine to recharge its batteries—the first hybrid electric vehicle. 1968: General Motors developed the GM XP 512, which ran on electricity at low speeds and gasoline at high speeds. 1997: Toyota launches the Prius in Japan, marking the start of modern hybrid vehicles. 2000: The Prius enters the US market. 2002: Hybrids become fairly common in the marketplace. Honda introduces the Accord Hybrid. 2004: Ford introduces the first hybrid SUV, the 2005 Ford Escape. 2024: Ford unveils the 2025 Maverick, the first hybrid compact pickup truck.” |

Once criticized for being underpowered, modern hybrids have shattered that myth by delivering a seamless combination of responsive handling, efficient fuel use, and smooth gas-electric integration.

The Toyota Prius, once a symbol of hybrids, now boasts 60% more horsepower while maintaining top-tier fuel economy.

Larger models like the Jeep Wrangler PHEV show hybrids can handle off-road adventures, appealing to thrill-seekers and those needing versatile, high-performance vehicles.

Larger hybrids like the Jeep Wrangler PHEV also flex their muscles, proving that efficiency and power can coexist.

What’s one of the most overlooked benefits of hybrid car marketing? |

|

| “Hybrid vehicles offer an “under-the-radar” benefit to manufacturers and brands: they generally conquest customers from competing brands at a higher rate than their gasoline-fueled counterparts (and higher conquests imply lower internal cannibalization, something brands want to avoid).This finding, rarely mentioned, came to light in our S&P Global Mobility analysis of the conquest patterns of 19 incremental hybrid models and their gas-powered counterparts. (An incremental hybrid model is a model with a hybrid propulsion system that is added to a brand’s product portfolio.)” Steve Giordano, SME Automotive Client Loyalty Principal – Mobility Consulting Services, S&P Global |

Building on the rebranding of hybrids as powerful, versatile vehicles, automakers are heavily promoting their eco-friendly benefits and fuel savings.

Campaigns like Toyota’s “Electrified Diversified” showcase a broad lineup of hybrid powertrains as part of the push toward carbon neutrality.

Honda’s CR-V Hybrid emphasizes its 204-horsepower engine and real-time AWD, proving hybrids can tackle snowy roads and city commutes with ease and without trade-offs.

Hybrid vehicles attract buyers from competing brands. Conquest rates, which measure the percentage of buyers switching from another brand, highlight this trend.

According to an S&P Global Mobility analysis, 14 of 19 recently introduced hybrid models had higher conquest rates than their gasoline counterparts.

Hybrids dominate the compact utility segment, showcasing strong appeal in competitive markets. Rather than cannibalizing sales, they attract new buyers, making them a strategic win for automakers.

As the auto industry moves toward electrification, hybrids are seen as a practical step before fully adopting EVs. Several factors drive this trend:

Hybrids are gaining traction as transitional vehicles, but the shift to full electrification remains gradual.

Why are hybrids a natural transition to electric vehicles? |

|

| “It’s no surprise that hybrid vehicles are rising in popularity, especially with many potential EV buyers pointing to environmental concerns as their motivation to purchase. With many still hesitant to go all in with EVs, hybrids offer an ‘easier-to-swallow’ solution: the security of ICE with the advancements of EV technology and performance. For those looking to transition due to the environment, hybrids allow owners to lessen their reliance on fuel and create options for batteries and parts. For many, it’s a win-win.” Raman Ram, Defense & Mobility Leader, EY Americas Aerospace |

As greener transportation options grow, consumers face a key choice: hybrids or EVs. The decision comes down to driving habits, budget, and environmental goals.

Hybrids have a lower sticker price than EVs. In October 2024, the average transaction price for a new EV was $56,902, whereas hybrid vehicles averaged $39,040.

Although federal tax incentives can reduce EV costs, they don’t eliminate the higher upfront price. Hybrids remain a practical solution for those seeking advanced technology at a more attainable cost.

EVs have lower maintenance costs because they lack gas engines, so no oil changes or major mechanical issues exist. For example, an oil change at a dealership costs about $115–an expense EV owners skip.

Hybrids still need routine maintenance for their internal combustion engines, so upkeep is higher than that of EVs but less than that of traditional gas cars.

Hybrids can travel 30–75 miles on electric power and over 600 miles in hybrid mode, far outpacing EVs’ 100–300-mile range. With abundant gas stations and no charging delays, hybrids avoid range anxiety, making them ideal for road trips and rural areas.

Hybrid fuel costs are higher than EV charging, especially with expensive gas. A hybrid at 50 MPG costs $1,050 annually for 15,000 miles at $3.50/gallon. EVs average $750, or $500 with smart charging, based on $0.05/mile.

Hybrid batteries last 8–10 years or 100,000–150,000 miles, with replacement costs of $1,000–$8,000 (e.g., Toyota Prius: ~$3,800).

EV batteries often last a vehicle’s lifetime, but replacements can cost $5,500–$12,000 (e.g., Tesla Model 3: $7,000–$12,000; Nissan Leaf: ~$5,500). Both typically include warranties of 8 years or 100,000 miles.

Insurance Considerations:

Due to higher repair costs, insuring EVs can be more expensive. On average, EV insurance premiums are about 12% higher than those for comparable gasoline-powered cars.

Hybrids are more fuel-efficient than traditional gas vehicles but still emit tailpipe emissions.

EVs have zero tailpipe emissions, but their environmental impact depends on the electricity source. Charging with renewables keeps emissions low, while fossil fuel-based electricity increases the carbon footprint.

How should hybrids be marketed to appeal to a broader audience? |

|

| “It’s no surprise that hybrid vehicles are rising in popularity, especially with many potential EV buyers pointing to environmental concerns as their motivation to purchase. With many still hesitant to go all in with EVs, hybrids offer an ‘easier-to-swallow’ solution: the security of ICE with the advancements of EV technology and performance. For those looking to transition due to the environment, hybrids allow owners to lessen their reliance on fuel and create options for batteries and parts. For many, it’s a win-win.” Adam Herdman, Account Executive, KORTX |

For hybrid car marketers, every step of the customer journey is a chance to turn curiosity into conversions. Here’s how to approach each stage of the hybrid automotive marketing funnel:

In the early phase, buyers are casually researching the benefits of hybrid vehicles, intrigued by media discussions, or motivated by a desire for lower emissions and fuel costs without fully committing to an EV.

Key characteristics:

To engage potential buyers in this phase, marketers can use strategies such as:

At this stage, buyers recognize their need for a new car and actively consider a hybrid as their next vehicle.

Common triggers:

Marketing strategies in this phase should emphasize hybrid-specific advantages:

During this stage, potential hybrid buyers actively explore brands and models, focusing on what aligns with their lifestyles and values.

Key buyer focus areas include:

Effective marketing channels for this phase include:

Buyers are committed to purchasing a hybrid and are narrowing their options to specific brands and models.

Key buyer activities include:

Strategies to capture interest include:

In this final phase, potential hybrid buyers are ready to purchase.

They consider:

Marketing efforts should focus on streamlining the buying process:

📚 Explore our related automotive marketing resources:

|

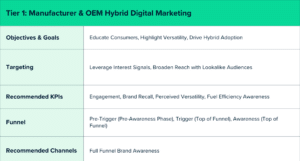

Marketing hybrid vehicles require a tiered approach that caters to different stages of the buyer’s journey and regional market nuances.

Tier 1 hybrid marketing builds national and global brand awareness, positioning hybrids as practical alternatives to gas and EV models.

Recommended Tactics:

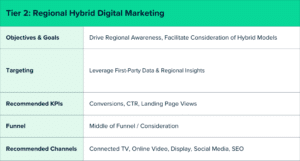

Tier 2 hybrid marketing emphasizes regional engagement, targeting buyers actively considering a hybrid vehicle. The goal is to guide potential buyers through their decision-making process by highlighting region-specific advantages.

Channels: Tailored Strategies for Regional Hybrid Marketing

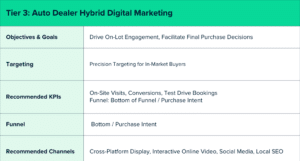

Tier 3 hybrid marketing is hyper-local, concentrating on driving foot traffic to dealerships and influencing final purchase decisions. The focus is highlighting local incentives, offers, and the tangible benefits of buying a hybrid vehicle.

Recommended Channels & Tactics:

For automakers and consumers alike, hybrids are emerging as a smart, flexible middle ground. They offer a chance to make meaningful progress toward environmental goals without asking drivers—or the industry—to leap before they’re ready.

As the hybrid sector gains momentum, it’s clear these vehicles are more than a transition—they’re a key piece of the puzzle on the road to a more sustainable future.

About the Author

Corey Rice is Director of Strategy at KORTX and has nearly 18 years of digital marketing experience. Prior to joining KORTX, he worked at agencies, publishers, and tech companies in San Francisco and Detroit.

From us to your inbox weekly.