Experiences refined for people

Experiences refined for people

Once consumers enter the market for auto insurance, companies have a seven-day window to capture their attention and secure their business. Car insurance marketing requires precise targeting on a specific calendar, aligning with customer behavior and buying preferences.

Discover the critical triggers and strategic timing that define the auto insurance marketing landscape.

Plus, essential insights for navigating these swift currents to engage potential customers effectively and convert interest into lasting loyalty.

“Adopting a full-funnel approach is crucial in the highly competitive auto insurance market. Consumers in this sector navigate the funnel at a rapid pace, making it essential to maintain visibility at every stage. This involves generating high-level awareness to stay top-of-mind and ensure inclusion in the consumers’ consideration. Additionally, targeting consumers during critical decision-making moments in the middle of the funnel is vital. Focusing on conversion and retargeting strategies at the bottom of the funnel is essential to securing leads or quotes.”

Understanding the key moments that prompt consumers to consider new or different auto insurance policies is critical.

By targeting these specific triggers, digital marketers in the auto insurance sector can craft more relevant campaigns that resonate with potential customers at critical decision points.

📚 Related article: Our Comprehensive Automotive Digital Marketing Guide: Curious about the car buyers journey? Check out our automotive marketing guide to learn more about car buying triggers and the automotive marketing funnel.

Understanding the different types of car insurance and identifying the target consumers for each can significantly enhance the effectiveness of digital marketing strategies in the auto insurance sector.

Comprehensive insurance covers damages to your car that are not caused by a collision, such as theft, vandalism, natural disasters, and animal impacts.

➡ Ideal for owners of new or expensive vehicles and those living in areas prone to theft, vandalism, or natural hazards.

Liability insurance covers expenses related to the damage or injury of others if you are at fault in an accident. This includes both property damage and bodily injury liability.

➡ ️ Mandatory for all drivers in most states and crucial for anyone who drives to protect the costs of damages and injuries to others.

Uninsured driver insurance protects you if you’re in an accident with an at-fault driver who does not carry liability insurance.

➡ Essential for all drivers.

Collision insurance covers damage to your car from a collision, regardless of who is at fault.

➡ Beneficial for drivers of newer or higher-value vehicles who want coverage for accident-related car damage.

Medical or Personal Injury Protection (PIP) covers medical expenses for you and your passengers in the event of an accident, regardless of who is at fault. It can also cover lost wages and other non-medical costs.

➡ Recommended for drivers in no-fault states and those seeking comprehensive medical expense coverage for themselves and passengers after an accident.

Gap insurance pays the difference between a vehicle’s actual cash value and the balance still owed on the financing if the car is totaled or stolen.

➡ Ideal for those who lease or finance their vehicles, significantly when the loan balance exceeds the car’s depreciated value.

Rental reimbursement insurance

Covers the cost of a rental vehicle while your car is being repaired after a covered insurance claim.

➡ Suitable for drivers who rely heavily on their vehicle for daily activities and need uninterrupted transportation, even when their primary vehicle is unavailable.

Roadside assistance offers services such as towing, flat tire changes, battery jump-starts, and lockout assistance in case of vehicle breakdown.

➡ Ideal for drivers seeking peace of mind for emergency services and those who frequently travel or have older vehicles.

Tailoring digital marketing to specific insurance buyers enhances engagement by providing relevant information and customized coverage. This strategy allows marketing teams to effectively meet their audience’s unique needs and concerns, ensuring a more meaningful connection.

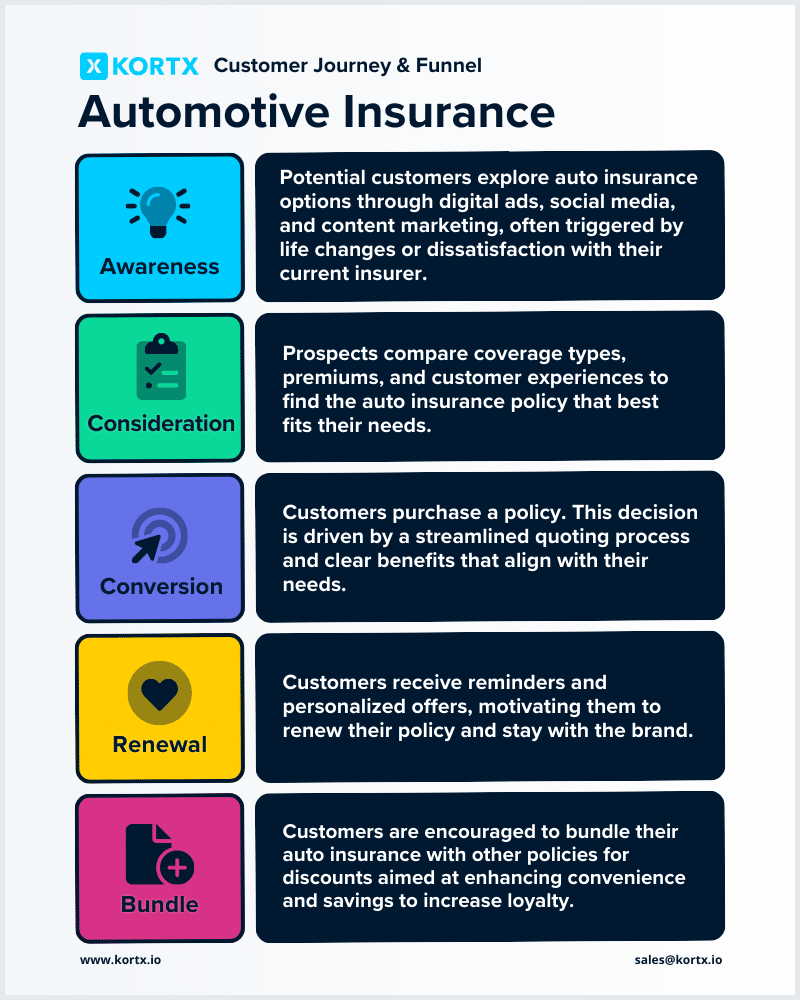

The auto insurance marketing funnel is a strategic framework that follows potential customers from discovering your brand to becoming loyal.

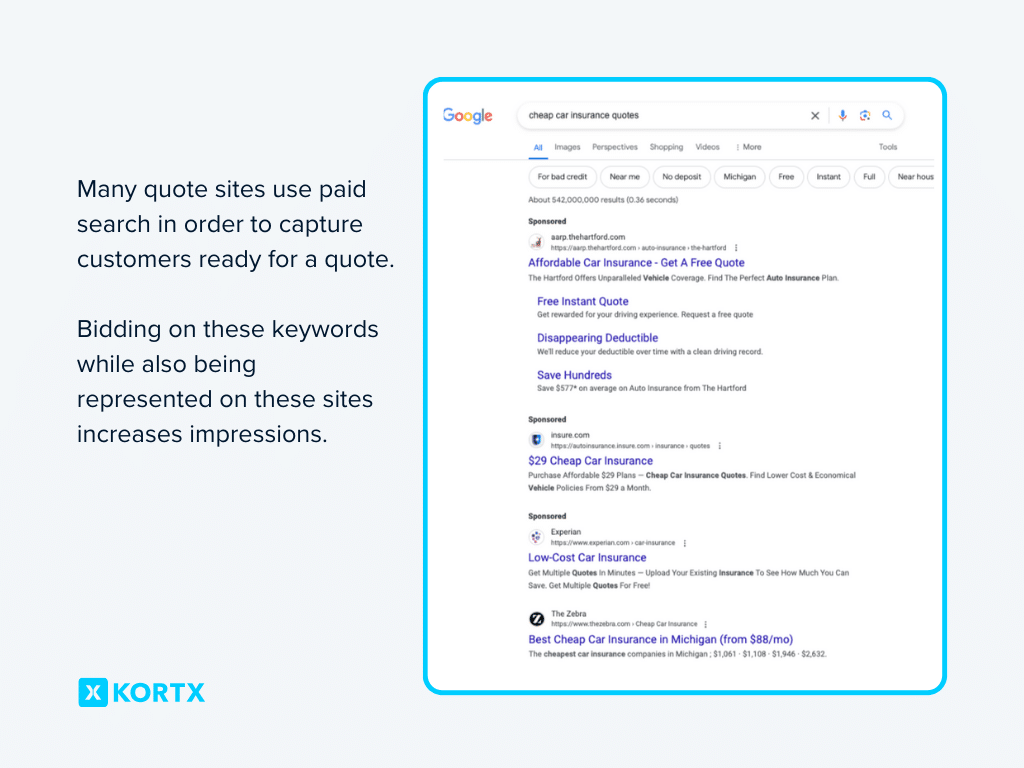

On average, it takes a customer 20 minutes to several hours to pick a new car insurance provider, depending on how long research takes. Quote sites often shorten this process by researching and comparing user quotes.

Here’s an integrated look at each stage:

💡 Awareness

Potential customers become acquainted with your auto insurance products and brand at this initial stage. Efforts cast a wide net through digital advertising, social media, and content marketing to capture the attention of those beginning their search for auto insurance, usually prompted by life changes or dissatisfaction with their current insurer.

“While content marketing has value throughout the customer journey, one of the primary roles of content for our brand is the demystification of insurance for the everyday buyer. While financial protection is vital to financial wellness, it is largely misunderstood, creating anxiety about where there should be peace of mind. It is through expert but easy-to-understand content, tailored to reach audiences where they are, that we empower our customers to make purchasing decisions with confidence.”

📋 Consideration

Prospects actively evaluate their options during consideration, comparing insurance coverage types, premiums, and customer experiences. The target audience here is consumers who have recognized their need for auto insurance and are researching the policy that best suits their needs.

🖱️ Conversion

At this critical point, a prospect purchases a policy from your company. Optimizing the customer experience with streamlined quoting processes and clear policy advantages is crucial in converting these ready-to-buy consumers who believe your offering aligns best with their requirements.

❤️ Renewal

The renewal phase focuses on keeping existing customers satisfied throughout their policy term to encourage them to renew. This involves engaging customers nearing their policy expiration with reminders, personalized offers, and incentives to provide compelling reasons for them to remain with your brand.

🗂️ Bundle

At this stage, the goal is to upsell and cross-sell by offering customers the option to bundle their auto insurance with other policies (like home or renters insurance) for additional discounts or benefits. It’s directed at current and future customers who could benefit from consolidating their insurance needs. Messaging should highlight the convenience and potential savings of bundling to enhance customer value and loyalty.

By seamlessly integrating these stages, auto insurance companies can attract, engage, and retain customers, fostering long-term relationships and driving sustainable growth.

Auto insurance digital marketing requires a nuanced approach, leveraging sophisticated targeting, seamless user experiences, and timely engagement to attract and retain customers.

The foundation of a successful insurance digital marketing strategy lies in the sophistication and expertise of audience targeting. Utilizing First-Party data and advanced modeling goes beyond mere media product selection, enabling insurers to pinpoint their ideal customer segments. Marketing efforts are more efficient, and potential customers see more relevant messages.

Before choosing a specific promotion platform, car insurance marketing teams should determine who they wish to target (age, location, and other demographic details).

A brand aimed towards younger car buyers (like Lemonade Insurance) may do better on TikTok, while other brands may target older adults through CTV commercials.

The design of user-friendly landing pages is central to converting interest into actionable leads. These pages must provide information to inform visitors while optimizing the layout and content to encourage quote requests. Highlighting bundle options is essential, yet it’s crucial to do so in a manner that informs customers without overwhelming them, ensuring a smooth path to conversion.

“Properly tagging your site is a technical necessity and a strategic move that can significantly enhance your performance and measurement. Imagine a user exploring various auto insurance options. By tagging multiple areas on your site, you can precisely measure how many users navigate these pages after being served digital ads. This data empowers you to deliver a more customized message in your retargeting strategies based on the specific content they’re engaging with on your site.

For example, a user might engage primarily with Liability coverage options on your site. They aren’t ready to decide, so they go on about their digital experience like regular (scrolling socials, reading news articles, etc.). They then receive an ad from your company with an introductory offer for Liability-only insurance plans. This intrigues them to go back to your site and request a quote. This sequence of events through tracking and attributing these site actions is only possible with properly placed tags.”

A seven-day window of opportunity underscores the urgency of engaging potential customers as they enter the market. This timeframe stresses the importance of rapid and effective marketing to capture the attention of those with immediate insurance needs, such as new car purchases or relocations.

Post-acquisition, the marketing focus shifts towards cross-selling through bundle programs, encompassing auto, home, life, and business insurance. This strategy elevates the customer’s value to the company and reinforces their loyalty. As the initial product offering, auto insurance often receives the most funding, serving as a springboard for introducing customers to additional insurance solutions.

Targeting customers more likely to bundle their insurance provides an opportunity to save on ad spending and increase overall revenue.

Maintaining customer loyalty is as critical as acquiring new ones, with budget allocation for retention strategies being essential. According to Nationwide, the insurance industry boasts an average client retention rate of 84%. This statistic highlights the significance of investing in keeping customers satisfied and engaged, ensuring long-term loyalty, and reducing churn.

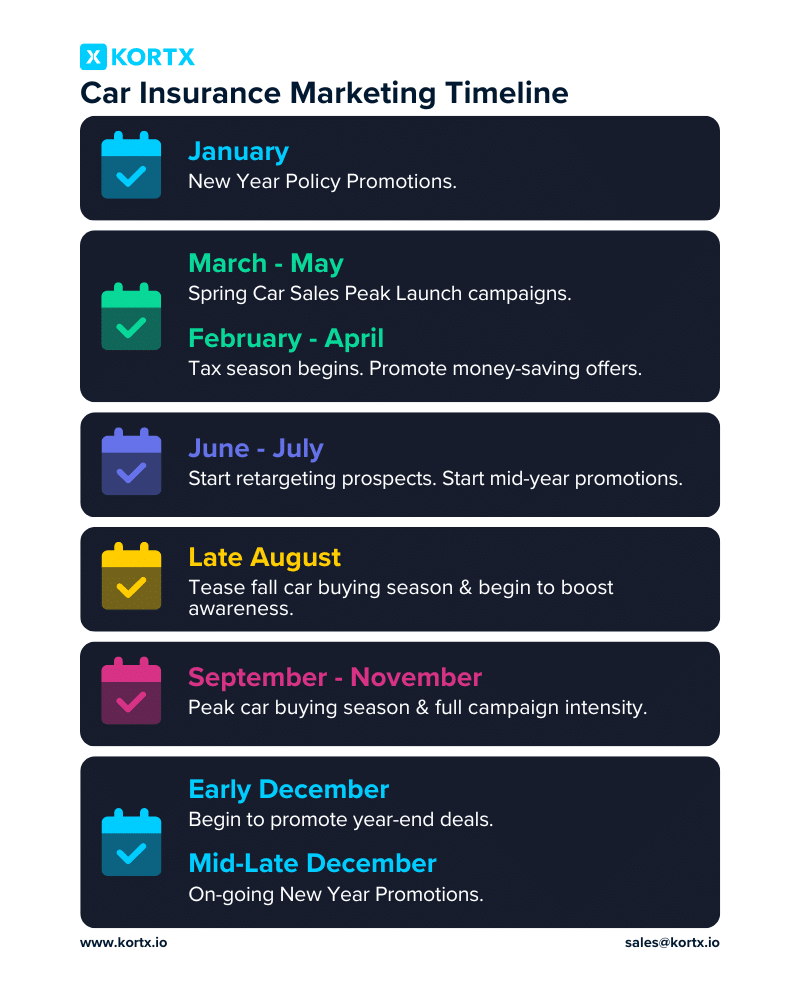

Capitalizing on the ebb and flow of consumer behavior throughout the year can significantly enhance the impact of auto insurance marketing efforts. By understanding and acting on key seasonal trends, insurers can tailor their strategies to align with when potential customers are most likely to be in the market for new or updated policies.

Our recommended car insurance marketing timeline.

The auto industry sees significant sales increases during two main periods: the spring (March through May) and the fall (September through November). New vehicle model releases drive these spikes and the corresponding rise in consumer interest in purchasing new cars, often at higher prices.

To leverage these peak car-buying times, auto insurance marketers should initiate comprehensive awareness campaigns ahead of and during these seasons. A mix of CTV commercials, display ads with mascots, social media, and targeted emails captures the attention of vehicle shoppers, keeping the insurance brand top of mind.

Quote websites, like TheZebra.com and Sofi, offer a platform where users can compare auto insurance quotes from various providers, including your brand. Car insurance companies can pay to be featured on these sites, gaining visibility among potential customers who are actively shopping for insurance.

✅ Pros:

❌Cons:

Auto insurance is the gateway for brands to introduce customers to their suite of products, backed by substantial marketing efforts.

Once a customer is onboarded with an auto policy, the strategy swiftly shifts towards cross-selling through bundle programs. These bundles typically include additional family vehicles (Auto), Home (Property/Rental), Life (Personal), and Business (Company) insurance.

Insurers may also expand their bundle offerings to encompass specialized forms of insurance, such as Motorcycle, Landlord, and Umbrella policies, among others.

This method streamlines the insurance process by consolidating policies under one provider, increasing customer loyalty and retention through discounts and seamless service.

Aligning marketing strategies with consumer behavior and seasonal trends is critical to capturing attention and driving conversions. Through targeted campaigns, strategic timing, and an understanding of customer needs, insurers can navigate the marketing funnel effectively.

Embracing a multi-faceted approach that includes leveraging data, understanding the importance of timing, and the power of bundling, auto insurance companies can not only meet but exceed the expectations of today’s savvy consumers, ensuring long-term success in a competitive market.

Sam Wilson is a Sr. Account Executive at KORTX. He brings over a decade of experience working across various verticals on both regional and national campaigns. Sam’s expertise lies in cultivating strong client relationships, devising strategic campaigns, and delivering measurable results that exceed exceptions.

From us to your inbox weekly.